The tax invoice unveiled by Republicans within the House on Thursday wouldn’t, as had been rumored, remove the tax penalty for failure to have medical insurance. But it could remove a decades-old deduction for individuals with very excessive medical prices.

The controversial bill is an effort by Republicans to revamp the nation’s tax code and supply dramatic tax cuts for enterprise and people. However, its future is just not but clear as a result of Republicans, who management each the House and Senate, seem divided on key measures.

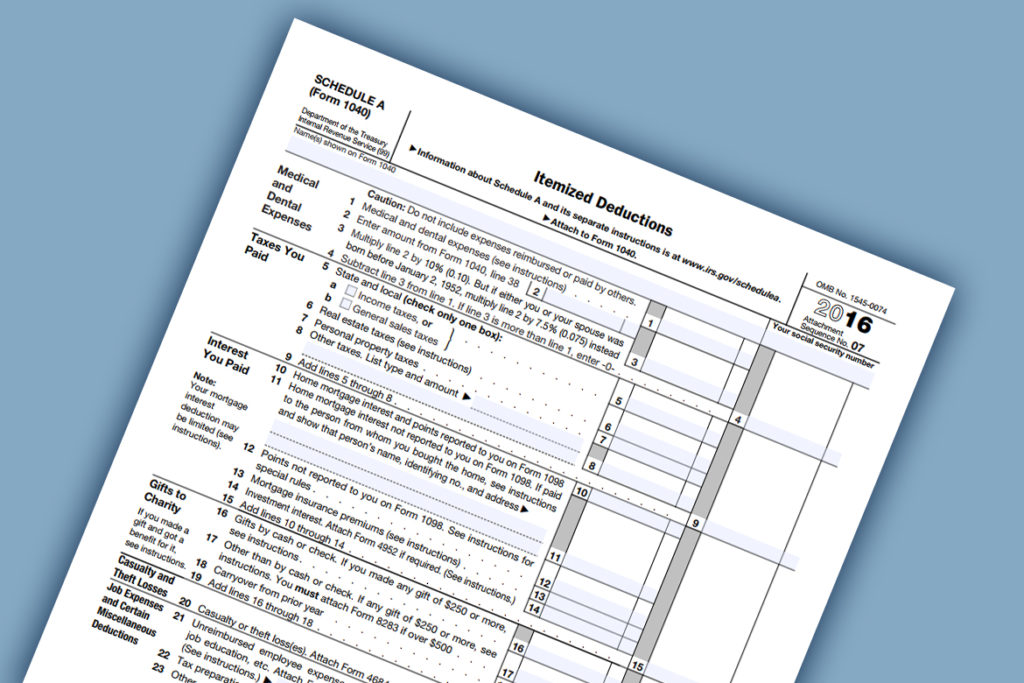

The medical deduction, initially created in World War II, is accessible solely to taxpayers whose bills are above 10 p.c of their adjusted gross earnings.

Because of that threshold, and since it’s obtainable solely to individuals who itemize their deductions, the medical expense deduction is just not utilized by many individuals — an estimated Eight.Eight million claimed it on their 2015 taxes, according to the IRS.

Use Our ContentThis KHN story might be republished totally free (details).

But these Eight.Eight million tax filers claimed an estimated $87 billion in deductions; that means that those that do qualify for the deduction have very excessive out-of-pocket well being prices.

“For many people, this is a big deduction,” mentioned David Certner, legislative counsel for AARP, which opposes the change. AARP has calculated that about three-quarters of those that declare the medical expense deduction are 50 or older, and greater than 70 p.c have incomes $75,000 or beneath. Many of these bills are for long-term care, which is usually not lined by medical insurance. Long-term care can price 1000’s or tens of 1000’s of a yr.

Sen. Ron Wyden (D-Ore.), rating member of the tax-writing Senate Finance Committee, known as the invoice’s elimination of the medical expense deduction “anti-senior.”

But defenders of the invoice say the elimination of the deduction shouldn’t be seen in isolation.

Related Content

The House tax invoice additionally proposes eliminating billions of in corporate tax credits which have performed a key function within the booming “orphan drug” trade.

In an FAQ posted on the House Ways and Means Committee website, the invoice’s sponsors denied that the change would “be a financial burden.”

“Our bill lowers the tax rates and increases the standard deduction so people can immediately keep more of their paychecks — instead of having to rely on a myriad of provisions that many will never use and others may use only once in their lifetime,” the sponsors mentioned.

Getting rid of many present deductions “is being done to finance rate cuts and increase the standard deduction and child tax credit,” mentioned Nicole Kaeding, an economist with the business-backed Tax Foundation. So, for a lot of tax filers, she mentioned, “there will likely be offsetting tax cuts.”

On the opposite hand, these offsetting cuts nearly by definition is not going to make up the distinction for individuals with very giant medical bills, who’re the one ones who qualify for the medical deduction.

“That’s why tax reform is hard,” Kaeding mentioned.

Strikingly absent from the invoice — for now — is any reference to the elimination of the tax penalty for failure to have medical insurance. The so-called particular person mandate is likely one of the most unpopular provisions of the Affordable Care Act, which Republicans failed to vary or repeal earlier this yr.

Sen. Tom Cotton (R-Ark.) is continuing to push language so as to add to the invoice that may remove the penalty. President Donald Trump has added his endorsement through Twitter: “Wouldn’t it be great to Repeal the very unfair and unpopular Individual Mandate in ObamaCare and use those savings for further Tax Cuts,” he wrote Wednesday.

But whereas the president is right that there could be financial savings from eliminating the mandate, the Congressional Budget Office has additionally estimated that thousands and thousands extra Americans would turn into uninsured because of this.

Cost and Quality, Health Care Costs, Health Industry

Legislation, Tax Penalties, U.S. Congress

jrovner@kff.org”> jrovner@kff.org | @jrovner

src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>