Arthur J. Villasanta – Fourth Estate Contributor

Washington DC, United States (4E) – The wealthy will probably be all smiles whereas the remainder of Americans will probably be wallowing in despair when Donald Trump indicators the massively unpopular Tax Cuts and Jobs Act of 2017, which is able to make the moneyed class within the USA (together with Trump) far richer than they’re right this moment on the expense of the poor and center class.

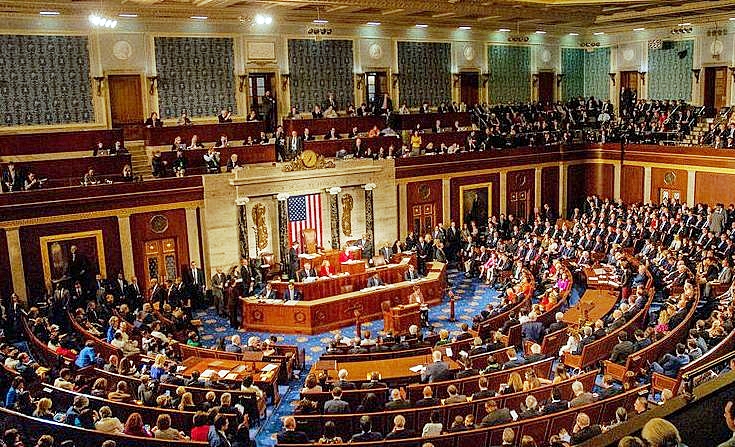

The Republican Party’s toxic Christmas reward to the non-rich is predicted to be signed into regulation by Trump earlier than Christmas Day. No congressional hearings; no debates and no inputs from the Democrats went into this invoice that was railroaded by means of Congress by the GOP determined to have at the least one huge legislative win in 2017.

The GOP-sponsored Tax Cuts and Jobs Act is the biggest one-time discount within the company tax price in U.S. historical past. Last-minute modifications to this invoice give the wealthy a bigger tax break in comparison with these contained within the authentic House and Senate payments.

The new tax minimize for the wealthy cuts the highest tax price for prime earners. Under present regulation, the very best tax price is 39.6 p.c for married couples incomes over $470,700. The GOP invoice will scale back that price to 37 p.c.

It may also increase to $500,000 for people and $600,000 for married couples the edge at which that prime price will probably be applied.

Analysts agree these new ceilings quantity to a big tax break for the very rich. The giveaway belies repeated claims by Trump and the GOP that the invoice will not minimize taxes on the wealthy.

Republicans additionally went to nice lengths to make sure the rich in states reminiscent of New York, Connecticut and California do not find yourself paying considerably larger taxes on account of the invoice.

The invoice additionally means a large tax minimize for firms.

Starting Jan. 1, 2018, the tax price on huge enterprise will plunge to solely 21 p.c from 35 p.c, which is able to the biggest one-time price minimize in U.S. historical past for the biggest U.S. firms.

This windfall for giant enterprise quantities to a $1 trillion tax minimize over the following decade. Republicans argue this can make the economic system surge within the coming years, however most impartial economists and Wall Street banks predict solely a modest and short-lived increase to progress.

The invoice lowers taxes for the overwhelming majority of Americans, in addition to small-business house owners. These cuts expire after eight years, nonetheless.

The GOP invoice is much less charitable to middle-class and poor households.

It preserves a couple of tax financial savings for the center class. These embody the student-loan curiosity deduction; the deduction for extreme medical bills and the tax break for graduate college students.

One of probably the most controversial components of the GOP invoice is the massive discount in how a lot state and native taxes Americans can deduct on their federal earnings taxes.

Today, State and Local Deduction (SALT) is limitless below present legal guidelines.

In the ultimate Republican plan, particular person taxpayers can deduct solely $10,000 in state, native and property taxes. The House initially restricted the $10,000 deduction to only property taxes.

Working-class households will get an even bigger baby tax credit score, and the kid tax credit score will probably be extra beneficiant for low-income households and the working class.

The present baby tax credit score is $1,000 per baby. The House and Senate payments expanded the kid tax credit score to $2,000 per-child.

It additionally makes extra of the tax credit score refundable, which means households that work however do not earn sufficient to really owe any federal earnings taxes will get a big test again from the federal government.

The invoice will take away Obamacare’s particular person medical insurance mandate in 2019.

Beginning in 2019, Americans will now not be required by regulation to purchase medical insurance, and pay a penalty in the event that they refuse to take action.

The particular person mandate stays unpopular, but it surely’s what retains insurance coverage markets steady whereas making different, extra widespread components of the regulation work, such because the requirement that insurance coverage firms cowl individuals with pre-existing situations.

Removing the person was a prime precedence for Trump and congressional Republicans. The last invoice doesn’t begin the repeal till 2019, nonetheless.

The Congressional Budget Office estimates that repealing the person mandate will enhance insurance coverage premiums and result in 13 million fewer Americans with insurance coverage in a decade. The repeal may also slash authorities spending by greater than $300 billion over that interval.

The Joint Committee on Taxation estimates the invoice will slash federal income by $1.456 trillion over 10 years, a key discovering because the invoice cannot afford so as to add greater than $1.5 trillion in debt and qualify for particular Senate guidelines.

Democrats will stay united in opposition to the invoice. They say the measure supplies most of its advantages to rich people and companies and can find yourself elevating taxes on some middle-class households.

Article – All Rights Reserved.

Provided by FeedSyndicate