Use Our Content This story may be republished free of charge (details).

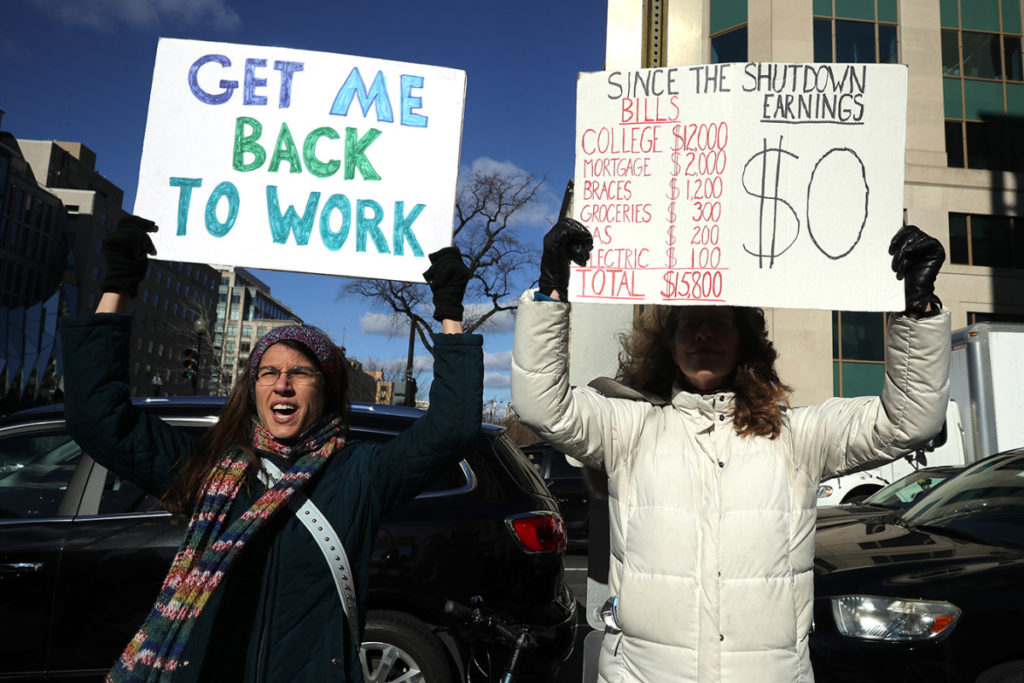

As the partial authorities shutdown drags on, about 800,000 federal staff who work for the shuttered businesses — and their households — are dealing with the truth of life and not using a paycheck.

And these staff want to contemplate a number of different associated points as they try and make ends meet.

For starters, what is going to occur to their medical health insurance?

For probably the most half, federal staff needn’t fear about that, in line with the Office of Personnel Management (OPM) in an FAQ weblog put up.

Both the web FAQ and the medical health insurance business’s commerce affiliation verify that protection by the Federal Employees Health Benefits (FEHB) program will proceed even when some federal businesses affected by the shutdown aren’t issuing these paychecks or paying premiums.

“The shutdown should not impact their coverage,” stated Kristine Grow, spokeswoman for America’s Health Insurance plans, the commerce group that represents insurers, together with people who supply protection by the federal program. “It’s business as usual.”

Once the shutdown ends and people funds resume, staff ought to count on that their traditional share of premiums plus among the collected quantity that wasn’t deducted in the course of the missed pay durations might be taken out.

“Procedures may vary somewhat by payroll office, but the maximum additional deduction allowed under regulations is one pay period’s worth of premiums (in addition to the current pay period’s premium),” stated an OPM spokeswoman.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

What about authorities contract staff?

Less clear is what occurs to staff below contract with the affected federal businesses — together with some individuals working as analysts, administration assistants and janitorial employees — who’re largely excluded from the FEHB program.

Many corporations that contract with the federal authorities supply staff insurance coverage. The federal Office of Personnel Management recommends these contracted staff seek the advice of the human sources workplace at their firm for solutions relating to the shutdown.

“In 95 percent of cases, even if it’s not required by law, I would think most everyone would continue that coverage,” stated Rachel Greszler, a senior coverage analyst and analysis fellow on the Heritage Foundation who research economics, funds and labor points.

For contract staff who purchase their very own protection and are struggling to pay payments with out their paychecks, it’s a special story. One technique could also be to ask their insurers for a grace interval in paying their premiums, just like how the federal government has instructed staff search lodging from mortgage lenders and different collectors. But there is no such thing as a requirement that insurers grant such a request.

“We are concerned about the disruption that this shutdown has caused our members and their families,” famous a company assertion from CareFirst BlueCross BlueShield. “We are currently exploring how to best address this issue should the shut-down continue.”

What else may very well be affected?

Depending on how lengthy the shutdown lasts, dental, imaginative and prescient and long-term care insurance coverage applications could begin sending payments on to staff.

Federal staff pay the premiums for these advantages themselves, in line with Dan Blair, who served as each performing director and deputy director of the OPM in the course of the early 2000s. He is now a senior counselor and fellow the Bipartisan Policy Center.

Because staff’ checks will not be being processed, the quantities often despatched to those carriers every pay interval additionally aren’t being paid. If the shutdown lasts longer than two or three pay durations, staff will get premium payments straight from these companies and may pay them “on a timely basis to ensure continuation of coverage,” the OPM says in its FAQ. Blair agrees.

There additionally could also be a delay in processing claims for versatile spending accounts. These are particular accounts through which staff use pretax cash deducted from their paychecks to cowl sure eligible medical bills, comparable to eyeglasses, braces, copayments for physician visits or drugs, together with some over-the-counter merchandise. With no paychecks going out, these deductions will not be being made and transferred into FSAs. Once paychecks begin up once more, the quantity deducted might be adjusted so the employee will get the annual complete they’d requested.

During the shutdown, although, reimbursement claims to those accounts additionally received’t be processed, the OPM says. Blair suggests holding off on big-ticket purchases in the course of the shutdown, if potential, and all the time protecting paperwork on the purchases.

Another consideration: Those who modified plans earlier than the furlough could discover their paperwork wasn’t processed in time.

In these circumstances, the OPM says to stay with the outdated well being plan till the shutdown ends and the brand new plan is processed. The new plan will choose up any claims incurred.

How will staff know if their change was processed? The OPM’s FAQ says staff who obtain an ID card within the mail are enrolled.

“The new policy will be what applies and pays benefits, but there could be some administrative burdens and hassles on the part of workers if the shutdown continues much longer, if the initial bills are not going to the right insurance company,” Greszler stated.

Overall, Blair says staff ought to proceed to watch information media websites, notably these that target federal staff and points, in search of any updates.

“We’re getting into uncharted territory and there are always things that pop up that no one has planned for,” stated Blair, who didn’t face any shutdowns throughout his tenure at OPM.

Use Our Content This story may be republished free of charge (details).

Julie Appleby: jappleby@kff.org”>jappleby@kff.org, @Julie_Appleby

Related Topics Health Industry Insurance Public Health Dental Health Premiums Vision Care src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>