Felicia Morrison is keen to discover a well being plan for subsequent 12 months that prices lower than the one she has and covers extra of the medical providers she wants for her persistent autoimmune illness.

Morrison, a solo lawyer in Stockton, Calif., buys protection for herself and her twin sons by means of Covered California, the state’s Affordable Care Act insurance coverage market. Morrison, 57, will get a federal subsidy to assist pay for her protection and she or he mentioned that her month-to-month premium of $167 is manageable. But she spends hundreds of dollars a 12 months on deductibles, copayments and care not coated by her plan.

“I would just like to have health insurance for a change that feels like it’s worth it and covers your costs,” she mentioned.

Her likelihood is trying up after lawmakers in Sacramento acted to reinforce Covered California for 2020: They added state-funded tax credit to the federal ones that assist individuals pay for protection. And they reinstated a requirement for residents to have protection or pay a penalty — an effort to make sure that sufficient wholesome individuals keep within the insurance coverage swimming pools to offset the monetary burden of shoppers with costly medical issues.

An additional benefit of those new insurance policies: They attraction to insurers, that are increasing operations within the state, enhancing competitors and providing customers extra decisions.

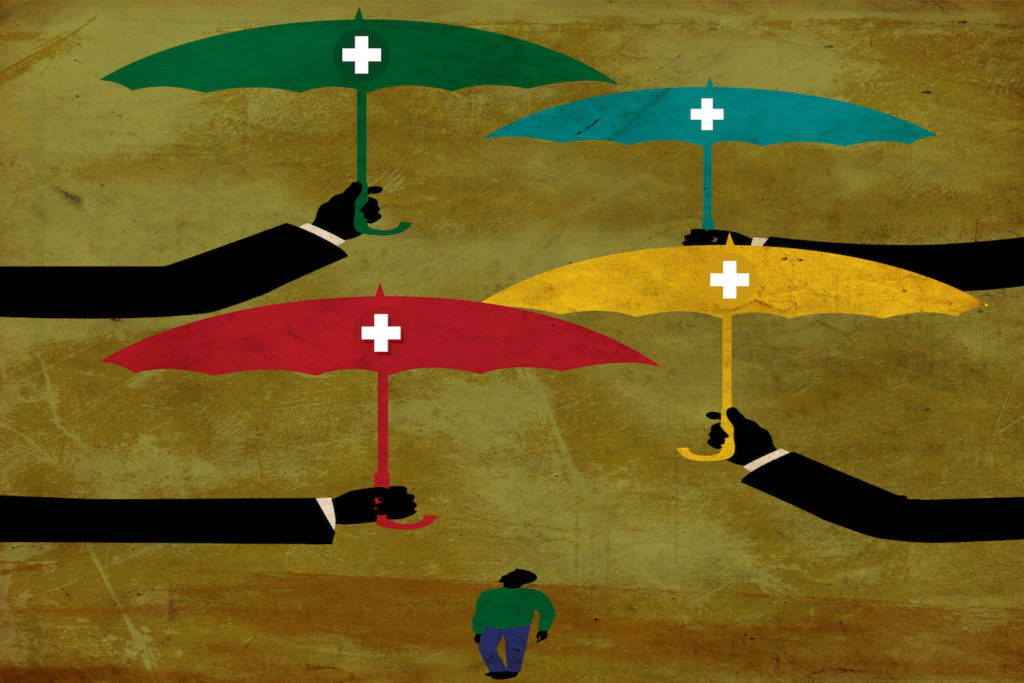

California’s ACA alternate shouldn’t be the one one benefiting from the renewed curiosity of insurance coverage corporations. Other states are anticipated to see extra insurers enter or re-enter their marketplaces subsequent 12 months. That’s a essential sign, specialists mentioned, that the state-based marketplaces, which cowl about 11 million individuals nationally, have gotten extra strong and fewer dangerous for insurers — regardless of ongoing political and authorized battles over the ACA.

“It’s taken longer than expected, due in part to the political rancor, but things seem poised to go well for next year,” mentioned Katherine Hempstead, a senior coverage adviser on the Robert Wood Johnson Foundation. “The ACA market is becoming a better place for insurers and consumers.”

Hempstead mentioned 2020 would seemingly be the second 12 months in a row with a web enhance within the variety of insurers collaborating and comparatively modest premium increases nationwide.

Covered California mentioned final month it anticipated an average premium increase of simply zero.eight% in 2020, far beneath this 12 months’s hike of practically 9% and the bottom because the company started enrolling individuals in October 2013.

Peter Lee, Covered California’s government director, attributed subsequent 12 months’s slender fee enhance to the brand new state-funded premium subsidies and the requirement that folks be insured.

California is one in all a handful of states providing its personal subsidies to residents — and the primary to supply them to individuals making greater than the federal revenue threshold of 400% of the federal poverty stage. The subsidies can be found to individuals incomes as much as 600% of the poverty stage, that are people making as much as about $75,000 a 12 months and households of 4 with an annual revenue as much as $154,500. The further support is predicted to assist 235,000 households who didn’t beforehand qualify for federal assist.

California insurers have responded enthusiastically.

Anthem Blue Cross, which withdrew from a lot of the state’s particular person market in 2018, is leaping again in. It will broaden choices within the Central Valley and return to the Central Coast, Los Angeles County and the Inland Empire. Anthem well being plans can be accessible to almost 60% of Californians subsequent 12 months, in accordance with Covered California.

Blue Shield of California may also broaden its HMO plan into elements of Tulare and Riverside counties and add protection in Kings and Fresno counties. And the Chinese Community Health Plan will broaden to cowl all of San Mateo County subsequent 12 months.

“Nearly every Californian will be able to choose from two carriers, and 87% will have three or more choices in 2020,” mentioned Lee. He urged individuals to buy amongst plans, together with the brand new ones, to try to decrease their premiums.

“I definitely plan to look carefully at all new options,” Morrison mentioned.

Felicia Morrison, pictured along with her husband, Bryant, and sons, Neil and Nathan, buys protection for herself and her sons by means of Covered California. (Courtesy of Felicia Morrison)

Anthem, the nation’s second-largest well being insurer with 40 million enrollees in 10 states, additionally plans to broaden its ACA protection in Virginia subsequent 12 months.

Centene, which has 12 million enrollees nationwide, plans to broaden into new ACA markets subsequent 12 months as properly, an organization spokesperson mentioned. It operates in 20 states, three of which it entered for the primary time this 12 months.

Two startup insurers, launched in recent times partially to serve the ACA marketplaces, additionally plan expansions in 2020. Bright Health, based mostly in Minneapolis, introduced in late July that it’ll provide ACA plans in six extra states, on prime of the 4 it now serves.

And New York-based insurer Oscar, which this 12 months supplied ACA plans in 9 states, together with California, plans to enter Colorado, Pennsylvania and Virginia, in addition to new areas of New York and Texas.

Participation charges matter. A 2017 study by researchers on the Urban Institute discovered that the median month-to-month ACA premium that 12 months was $451 in areas with one insurer in contrast with simply over $300 in markets with three to 5 insurers and $270 in these with six or extra insurers.

The variety of insurance coverage corporations providing plans in ACA marketplaces has fluctuated. From 2014 to 2016, the common quantity was between 5 and 6, in accordance with the Kaiser Family Foundation. That quantity declined to three.5 final 12 months, following Republican threats to intestine or substitute the ACA and Trump administration adjustments to the marketplaces. (Kaiser Health News is an unbiased program of the muse.)

Premiums in some areas rose 20% to 30%.

This 12 months, the common variety of plans ticked up to four.

But variability amongst states remains to be substantial. Four states — Alaska, Delaware, Mississippi and Wyoming — have only one ACA insurer this 12 months. In distinction, seven states — California, Massachusetts, Michigan, New York, Ohio, Texas and Wisconsin – have eight insurers or extra.

“Anything less than three is not a good situation,” mentioned Sabrina Corlette, a analysis professor on the Center on Health Insurance Reforms at Georgetown University in Washington. “It looks like the marketplaces are stabilizing, though, and importantly the insurers are now making more money in this market.”

Kelley Turek, the director of business insurance coverage at America’s Health Insurance Plans, the primary commerce group for medical health insurance corporations, agreed. “The churn is finally slowing down,” Turek mentioned. “Companies are staying and expanding into new geographical areas. We strongly agree the market works best when consumers have more choice.”

The ACA marketplaces nonetheless want extra regulatory predictability, nevertheless, and political divisiveness over the ACA continues to undermine that, Turek mentioned.