Use Our Content This story might be republished without cost (details).

Health insurance coverage premiums and deductibles for job-based protection edged upward in 2019, surpassing will increase in each wages and inflation, in response to an annual employer survey of greater than 2,000 employers launched Wednesday. But the outcomes have been uneven, and plenty of staff least capable of afford it have been confronted with higher-than-average prices.

People at firms with massive numbers of lower-wage workers confronted larger deductibles for single protection and have been requested to pony up a bigger share of their incomes to pay premiums than these at companies with fewer folks with low earnings, in response to the annual employer health benefits survey by the Kaiser Family Foundation. (KHN is an editorially impartial program of the inspiration.)

The survey outlined firms with many lower-wage staff as these with at the very least 35% of workers incomes $25,000 or much less yearly. This includes many eating places and retail companies, private care service firms, and constructing and grounds cleansing and upkeep companies, amongst others.

More than 150 million folks get well being protection via plans provided by their jobs.

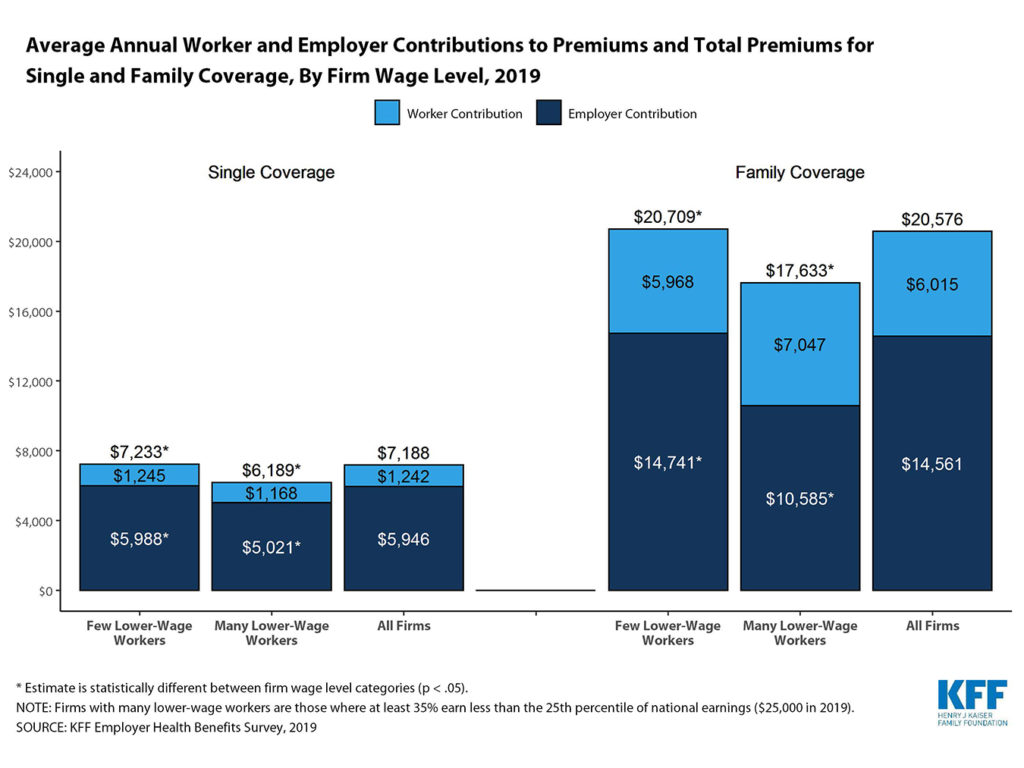

The survey discovered that the typical household protection ran $20,576 in 2019, a 5% improve over final 12 months. Workers paid practically 30% of the whole, or $6,015, on common.

The common premium for single protection rose four%, to $7,188, and staff paid $1,242 of that quantity, or about 18% of the whole. During the identical interval, inflation and wages grew at a slower charge, rising 2% and three.four%, respectively, a sample that has remained constant over the previous a number of years.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

The common deductible for single protection was $1,655, an quantity that has elevated by greater than a 3rd prior to now 5 years. More than 40% of lined staff had deductibles of at the very least $2,000 in 2019.

Many staff face costs along with a deductible. Eighty-five p.c of lined staff owed extra in the event that they have been hospitalized. The quantities different relying on the plan, from a median 20% coinsurance cost to a median $326 copayment. Two-thirds of lined staff additionally confronted a $25 copayment for physician’s workplace visits, whereas 1 / 4 confronted a coinsurance cost of 18%, on common.

As presidential candidates focus on adopting a “Medicare for All” strategy that will transfer folks into government-sponsored protection, one of many arguments in opposition to it’s that individuals would lose their employer-sponsored insurance coverage. But employer protection varies.

“There are a lot of people who feel pretty well serviced by their coverage,” mentioned Gary Claxton, a senior vp and director of the Program on the Health Care Marketplace on the Kaiser Family Foundation, who co-authored the examine and an accompanying article within the journal Health Affairs. “But there are a lot of people for whom it’s a little more challenging in terms of affordability and the protection their coverage provides.”

Fewer staff at firms with massive numbers of lower-wage staff have been eligible for protection within the first place, the survey discovered. Overall, 57% of firms provide medical insurance to their staff. But solely two-thirds of staff at lower-wage companies that provided protection have been eligible for it, in contrast with 81% of staff at different companies, in response to the survey. Companies might limit protection for staff who’re part-time, momentary or newly employed, for instance.

Workers allowed to enroll in a lower-wage agency’s plan might discover it takes a comparatively larger chunk out of their paychecks than staff at different firms.

While the whole premium for protection at these firms is much less on common than premiums at firms who’ve few low-wage earners, staff should pay a much bigger share of the price. For household protection, staff are on the hook for 41% of the complete value, or $7,047, in contrast with a 30% share for staff at different companies, or $5,968. (Workers’ share of the premium for single protection is far much less different: 18%, or $1,245, at firms with few low-wage staff versus 19%, or $1,168, at firms with many low-wage staff.)

“Costs are prohibitive when workers making $25,000 a year have to shell out $7,000 a year just for their share of family premiums,” Drew Altman, KFF president and CEO, mentioned in a press launch saying the examine’s launch.

One method to assist cut back the prices for lower-income staff is to base the quantity of their premium contributions on their wages, mentioned Brian Marcotte, president and CEO of the National Business Group on Health, which represents the pursuits of very massive employers, principally with at the very least 10,000 workers.

In 2019, a couple of third of these employers used a wage-based sharing system to calculate worker prices. Though usually utilized to premium contributions, such a mannequin can also be used to find out deductibles, out-of-pocket maximums or the quantity an employer contributes to well being financial savings accounts.

Deductibles are extra prevalent and could also be extra expensive at lower-wage companies than at firms with increased wages. The deductible for single protection, for instance, is at the very least $1,000 extra on common at lower-wage companies: $2,679 vs. $1,610.

Given the chance of the expense of premium contributions and deductibles, maybe it’s no shock that many staff at lower-wage firms select not to enroll in protection even when it’s provided.

Only a 3rd of staff at such firms that provided medical insurance signed up, the survey discovered. At higher-wage firms, the determine was considerably extra: 63%.

This 12 months, for the primary time because the Affordable Care Act was handed, staff now not confronted a tax penalty for not having medical insurance. Nine p.c of employers with at the very least 50 staff that provided medical insurance reported they thought the elimination of the penalty lowered the share of staff who signed up for protection.

In addition to being unaffordable for many individuals, protection at these lower-wage companies is probably not particularly complete, Claxton mentioned.

“Premiums are lower in low-wage companies because the coverage probably isn’t very good,” he mentioned.

“Basically, the company is saying [to workers], ‘Don’t buy it,’” mentioned Claxton. “And they don’t.”

Use Our Content This story might be republished without cost (details).

Michelle Andrews: andrews.khn@gmail.com”>andrews.khn@gmail.com, @mandrews110

Related Topics Cost and Quality Health Care Costs Insurance Deductibles Disparities KFF Premiums src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>