Inova Health System, with campuses in among the wealthiest suburbs of Washington, D.C., and Truman Medical Centers, a safety-net hospital in downtown Kansas City, Missouri, have little in frequent. But, in the present day, they’re confronting the identical monetary plague: mass cancellations of nonessential surgical procedures which can be their greatest moneymakers whereas bracing for an costly onslaught of coronavirus sufferers.

Yet Truman has lower than a month’s price of money reserves to maintain it afloat whereas Inova entered the outbreak with sufficient cash to function for not less than 21 months, in response to Inova’s financial disclosure for 2019, earlier than the inventory market decline. At that point, Inova informed its bondholders it had $three.1 billion in investments it might liquidate inside three days. Tapping any of which will by no means be obligatory as a result of Inova additionally drew down its whole $238 million line of credit score earlier this 12 months to organize for the pandemic.

“At the end of the day, not all hospitals are created equal,” stated Charlie Shields, Truman’s president and CEO. “If you were sitting on a year of … cash on hand, that would not be as challenging, but most safety-net hospitals are south of 25 days, and we’re probably around 10. How do you manage through that?”

But Dr. J. Stephen Jones, Inova’s president and CEO, stated, “Our finances are a mess at this point,” with the system suspending non-urgent remedies and eliminating 427 administration and administration positions.

“This is an existential threat to every health care organization, no matter how strong they come into it,” stated Jones, who reduce his personal wage by 25%.

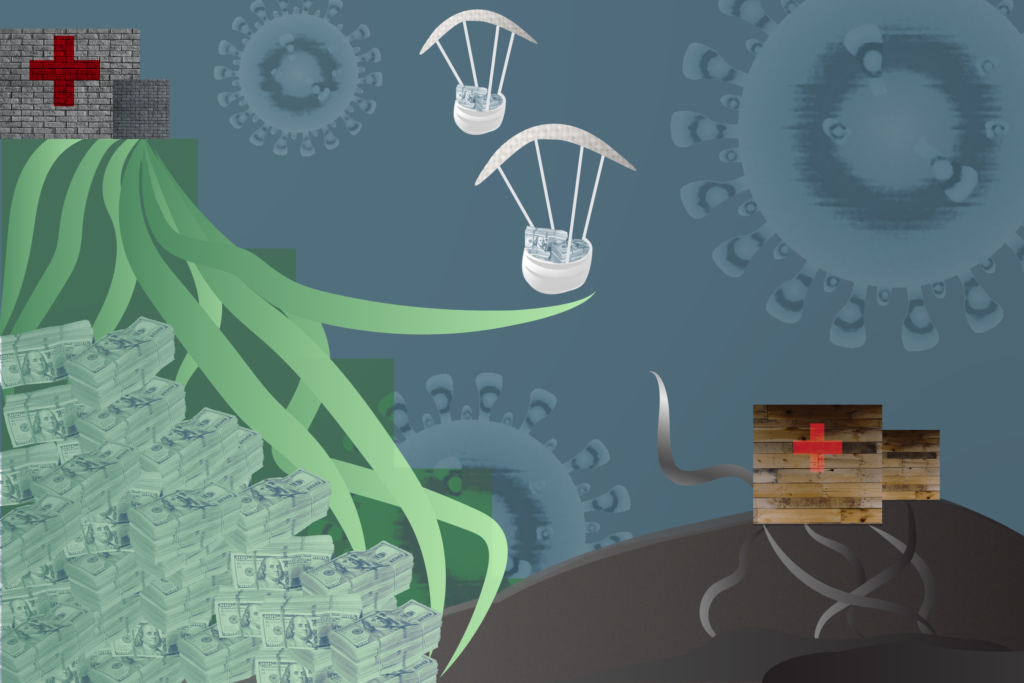

As the coronavirus wreaks havoc with hospital funds, rich hospitals sitting on tens of millions and even billions of are in a aggressive stampede towards near-insolvent hospitals for a similar restricted pots of monetary reduction. Those embody the $175 billion bailout fund Congress allotted for well being care suppliers as a part of two latest coronavirus packages and loans from non-public banks.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

Certainly, even the richest hospitals are having their steadiness sheets despoiled by a triple punch: the inventory market stoop, the price of preparation for coronavirus sufferers and the cessation of worthwhile surgical procedures, which is costing many hospitals half or extra of their revenues. Inova, as an illustration, has spent $32 million to purchase private protecting tools and set up adverse air stress techniques in 200 hospital rooms, Jones stated. (As of Monday morning, the system had 323 coronavirus sufferers.)

But in contrast to safety-net and smaller hospitals, many large well being techniques have the assets to remain afloat with out monetary help by the summer time and past. Half of the 284 hospitals whose bonds Moody’s Investors Service rated in 2018 had sufficient money readily available to cowl six months or extra.

They additionally don’t need to rely for survival on income from solely treating sufferers. Before the inventory market drop, 365 hospitals — about one in all each 13 — reported an funding portfolio exceeding $100 million, in response to a Kaiser Health News evaluation of hospital price reviews from 2018 filed with Medicare. Together, these investments pumped $2.Eight billion into these hospitals that 12 months.

“A lot of the big hospitals have developed fortress balance sheets since the financial crisis” of 2008, stated Chas Roades, co-founder and CEO of Gist Healthcare, a consulting agency. “The reflex is to protect the operation.” But, he stated, “if that’s a rainy day fund, it’s raining pretty hard right now.”

The wealthier hospitals face sacrifices that different hospitals would possibly envy, reminiscent of having to postpone formidable constructing initiatives or including to their already massive funding portfolios. They are much less involved with working out of cash than with depleting their money reservoirs a lot that their credit score rankings can be downgraded, which might result in larger borrowing prices.

“Most would prefer to have a line of credit than liquidate a stock holding,” stated Lisa Goldstein, an affiliate managing director at Moody’s.

UCHealth, a 12-hospital nonprofit system in Colorado, has briefly stopped contributing to its investments, which as of the tip of final 12 months totaled greater than $544 million in money and liquid investments and $four billion in long-term investments, in response to its monetary disclosure report. Even earlier than the pandemic, it had been stockpiling additional money to construct an 11-story tower on the University of Colorado Hospital in Denver that may price $388 million, stated Dan Rieber, UCHealth’s chief monetary officer. The system has sufficient liquidity to function for greater than 300 days with none new earnings and has obtained new traces of credit score.

But when massive well being techniques draw down these traces of credit score, it makes it tougher for smaller hospitals to get non-public help as a result of lenders could also be tapped out, stated Christopher Kerns, a vice chairman at Advisory Board, a well being care consulting agency. “In our own discussions with lenders, there’s only so much cash that’s available, and that is putting the squeeze on the small or midsize organizations, and they are finding themselves very crushed,” Kerns stated.

The federal Health and Human Services Department has not made monetary leeway belongings a consider deciding the way it will distribute the $100 billion bailout fund handed in March. The division is doling out the primary $30 billion based mostly on how a lot every well being care supplier was paid by Medicare final 12 months. The division plans to distribute the remaining cash with a watch towards the prevalence of coronavirus infections in a hospital or area, and within the variety of low-income and uninsured sufferers. The newest federal stimulus package deal — signed by President Donald Trump on Friday — added $75 billion to the reduction fund.

“There isn’t a mechanism right now to distinguish between the exceedingly well-endowed hospitals and those that are struggling,” stated Dan Mendelson, founding father of the consulting firm Avalere Health and a personal fairness investor.

The affiliation representing safety-net hospitals, America’s Essential Hospitals, has urged that money reserves be a consider divvying up the cash, which is broadly seen as inadequate to cowl all hospitals’ prices. Some member hospitals have fewer than 10 days of money reserves and run on common margins of 1.6%, a fifth of the business common, according to the group.

“Our hospitals are struggling now to manage surging patient volume, staff and supply shortages, and other severe challenges as their limited cash reserves dwindle,” Dr. Bruce Siegel, the affiliation’s president, stated in a press release.

Certainly, even the wealthiest hospitals are seeing their sturdy steadiness sheets being turned the wrong way up. Following the steering of the federal authorities, UCHealth has postponed elective surgical procedures, resulting in a drop in enterprise of 50% to 60%. Elizabeth Concordia, UCHealth’s CEO, stated the system expects that it’ll not utterly rebound even when the pandemic has diminished as a result of many older folks might be reluctant to return for elective surgical procedures for worry they may change into contaminated with the coronavirus.

She stated UCHealth can also be on the entrance traces of preventing the pandemic. It at present has admitted 240 COVID-19 sufferers, greater than another Colorado hospital, and has been analyzing assessments for rural hospitals with out but setting a contract for the way a lot it is going to be reimbursed. It has additionally maintained its 25,000-person workforce with out imposing pay reductions or furloughs.

“COVID is having a devastating impact on all of our finances,” Concordia stated.

But for these hospitals with their very own wealth, funding earnings can present a buffer that the majority hospitals don’t have. In a forthcoming paper within the Journal of General Internal Medicine, researchers on the Johns Hopkins Bloomberg School of Public Health led by Ge Bai discovered that almost all funding earnings for nonprofit hospitals have been earned by only a quarter of the hospitals. Without that quantity, their mixture internet earnings would have been 31% decrease.

Investment earnings made up 5% of the whole income for Trinity Health, a 92-hospital Catholic system based mostly in Michigan and working in 22 states, in response to its monetary disclosures to bondholders masking the final six months of 2019. Those funding earnings of $468 million accounted for 58% of Trinity’s surplus.

As of December, Trinity had $9.6 billion in money and investments, sufficient to function for six months. It additionally reported credit score traces totaling $1.2 billion. Trinity didn’t reply to requests for remark.

The wealthier hospital techniques are strongly positioned to take full benefit of no matter technique the federal government units for distributing the rest of the bailout funds. They make use of extra reimbursement workers and have in place subtle strategies to doc each expense that they will attribute to the coronavirus response, stated Simone Rauscher Singh, an assistant professor on the University of Michigan School of Public Health.

“The big hospitals are ramping up their capacity to document all this so they can go back later and say, ‘This is what we spent,’” she stated. “The small hospitals are going to be in an even worse position to do that.”

Jordan Rau: jrau@kff.org”>jrau@kff.org, @JordanRau

Related Topics Global Health Watch Health Industry Public Health States COVID-19 Hospitals src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>