Janina Lim – Fourth Estate Contributor

San Francisco, CA, United States CA – Netflix Inc., said it is hiking by a tenth the price for its most popular video streaming plan in a bid to generate more revenues slated for original programming and subsequently topple television rivals.

Netflix will now charge customers $11 per month instead of the previous $10 for the widely used package which allows people to simultaneously watch high-definition programs on two different internet-connected devices.

The streamline services provider’s premium plan which offers ultra-high definition video is also raised, up by 17 percent to $14 a month, while the basic plan which limits subscribers to one screen at a time without high-definition remains at $8.

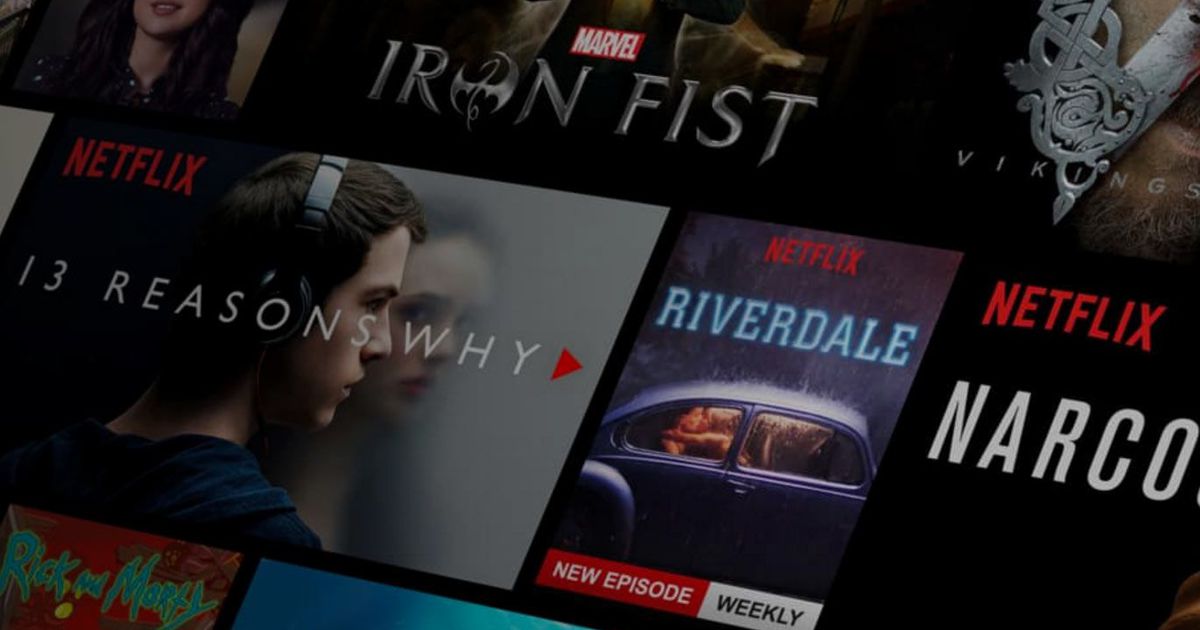

The price increase, the first since 2015, is prompted by Netflix’s aim to boost spending on original programming for shows such as “House of Cards,” ″Orange Is The New Black,” and “The Crown,” in addition to “Stranger Things.”

Those series’ success helped Netflix grab more Emmy award nominations than any TV network besides HBO this year. Chief Financial Officer David Wells earlier suggested that the company may soon finance $20 million on a single episode of TV.

The firm will notify affected subscribers, about 53 million in the US, by Oct. 19 to give them 30-days to continue the service at higher rates, switch to a cheaper plan or cancel the service.

For this year alone, Netflix expects to spend $6 billion on programming, and the expenses are likely to rise to $7 billion next year and in the years ahead as it competes against streaming rivals such as Amazon, Hulu, YouTube and, potentially, Apple for the rights to future shows and movies.

Amazon, at about $8.25 per month, offers a lower price than Netflix’s two plans while Hulu’s monthly fee ranges from $8 for a plan with commercials to $11 for a commercial-free plan.

RBC Capital Markets analyst Mark Mahaney thinks Netflix’s shows are compelling enough for a wide audience that the firm will retain its audience should it tag an even higher price to its packages

Mahaney estimates an additional $650 million in revenue to be generated next year from the price increase.

Meanwhile, Wedbush Securities analyst Michael Pachter believes less than 10 percent of Netflix’s current subscribers will cancel if prices rise again.

Shares of Los Gatos, California-based Netflix surged to an intraday record high of 4.5 percent in New York following the announcement of a price hike.

Article – All Rights Reserved.

Provided by FeedSyndicate