Arthur J. Villasanta – Fourth Estate Contributor

Washington, DC, United States (4E) – The Senate Republican model of the “Tax Cuts and Jobs Act” already underneath heavy criticism for making the wealthy richer and the poor poorer will make the wealthy much more wealthy and the poor much more poor, based on the most recent estimate from the nonpartisan Congressional Budget Office (CBO).

The plan will give big tax cuts and advantages to Americans incomes greater than $100,000 a 12 months. On the opposite hand, the poorest will likely be worse off than at present.

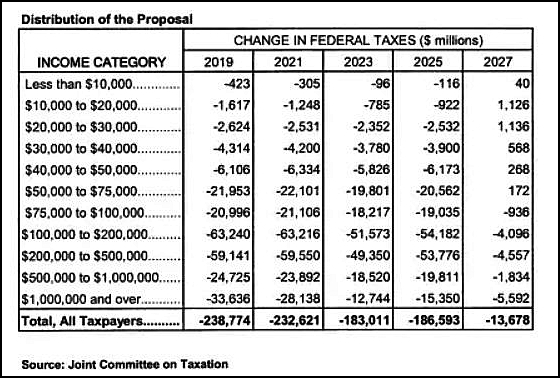

CBO mentioned that by 2019, Americans incomes lower than $30,000 a 12 months will likely be in additional dire straits underneath the Senate invoice. By 2021, Americans incomes $40,000 or much less will likely be web losers, and by 2027, most individuals incomes lower than $75,000 a 12 months will likely be poorer than they’re at present.

The wealthy, nevertheless, may have a heyday payday. Millionaires and folks incomes $100,000 to $500,000 will hit it massive, based on the CBO’s calculations. The major cause the poor will endure lots within the Senate GOP invoice is as a result of the poor will obtain much less authorities assist for healthcare.

The Senate Republican tax invoice eliminates the requirement that the majority Americans buy medical insurance or else pay a penalty, as offered for by Obamacare. CBO calculated that medical insurance premiums will improve if this invoice turns into legislation.

This larger expense will imply that over 4 million Americans will lose medical insurance by 2019 and 13 million will lose insurance coverage by 2027.

Many of the individuals doubtless to surrender their medical insurance have low or average incomes. Without medical insurance, these individuals will not obtain some tax credit and subsidies from the federal authorities.

The Joint Committee on Taxation (JCT), the opposite official nonpartisan group that analyzes tax payments, issued an analogous report exhibiting how lower-income households are harm by the lack of healthcare tax credit.

Unlike JCT, the CBO additionally calculated what would possibly occur to Medicaid, Medicare and the Basic Health Program if the Senate GOP plan turned legislation. The CBO reveals even worse impacts on poor households than the JCT did.

The CBO additionally mentioned the invoice would add $1.four trillion to the deficit over the subsequent decade, a possible downside for Republican lawmakers fearful about America’s rising debt.

Democrats have repeatedly slammed the invoice as a giveaway to the wealthy on the expense of the poor. In addition to reducing taxes for companies and lots of people, the Senate invoice additionally makes a serious change to medical insurance that the CBO initiatives would have a harsh impression on lower-income households.

Article – All Rights Reserved.

Provided by FeedSyndicate