Use Our Content This story might be republished free of charge (details).

It’s been a yr of enjoying protection for DaVita Inc., one of many nation’s largest dialysis suppliers.

A federal jury in Colorado this summer season awarded $383.5 million to the households of three of its dialysis sufferers in wrongful dying lawsuits. Then this month, the Denver-based firm introduced it will pay $270 million to settle a whistleblower’s allegation that considered one of its subsidiaries cheated the federal government on Medicare funds.

But its greatest monetary risk is a poll initiative in California that one Wall Street agency says might price DaVita $450 million a yr in enterprise if the measure succeeds.

Despite these latest hits, the corporate continues to rake in earnings and obtain favorable scores from inventory analysts. Its shares are buying and selling at about $65 a share, solely about 19 p.c under a 52-week excessive set in January. That’s largely as a result of DaVita controls about one-third of a rising market, well being specialists say.

“They don’t really have many rivals, and they perform a necessary, lifesaving service,” mentioned Leemore Dafny, a professor of enterprise administration at Harvard Business School. “If you’re producing something people want to buy and you’re the only one making it, people are going to buy it.”

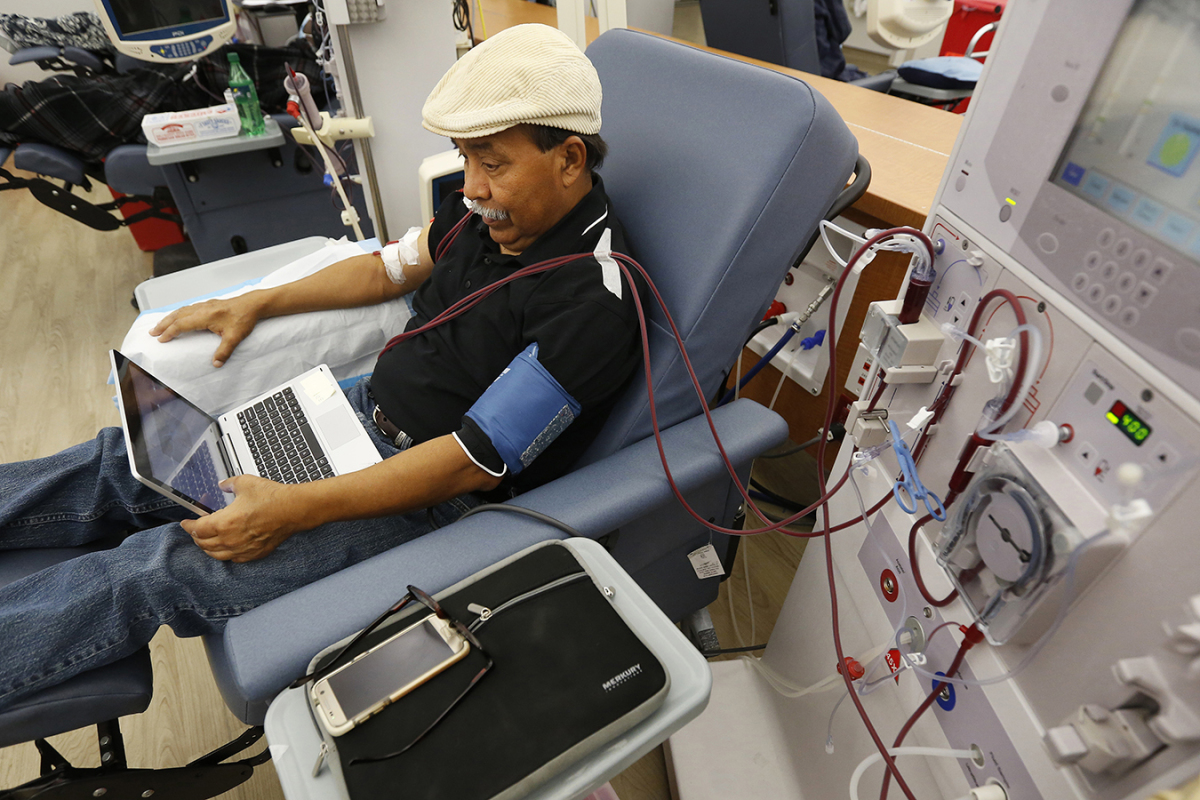

Patients with power kidney failure usually want dialysis to filter the impurities from their blood when their kidneys can now not do this job.

And as Americans reside longer and get heavier, extra individuals change into identified with kidney illness and probably want dialysis. In 2015, 124,114 new sufferers obtained dialysis, up from 94,702 in 2000, a 31 p.c improve, in keeping with the U.S. Renal Data System.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

DaVita is among the largest dialysis suppliers within the nation, working greater than 2,500 clinics nationwide. In California, the corporate operates 292 clinics, half of all power dialysis clinics within the state.

Its father or mother firm, DaVita Inc., reported $10.9 billion in income final yr and $1.Eight billion in earnings, nearly all of which got here from its dialysis enterprise.

This yr, firm officers mission the dialysis group will usher in $1.5 billion to $1.6 billion in earnings. It’s a giant turnaround for a company that would barely make payroll in 1999, when it was beneath evaluation by the Securities and Exchange Commission for questionable accounting practices. Its success has largely been credited to CEO Kent Thiry, a colourful persona who has dressed up as a Musketeer and ridden a horse into company conferences to rally staff.

Now these large earnings — generated from treating sick sufferers — has put a goal on the corporate’s again, in addition to that of its greatest competitor, Fresenius Kidney Care.

The Service Employees International Union succeeded this yr in putting Proposition Eight on California’s Nov. 6 poll, which might restrict dialysis middle business revenues to 115 p.c of affected person care prices. The poll struggle pits a well-funded business towards labor and the California Democratic Party.

DaVita declined to make anybody out there for this text, however in a press release mentioned Proposition Eight “will limit patients’ access to life-saving dialysis treatments, jeopardizing their care.”

Last yr, roughly two-thirds of DaVita’s dialysis income got here from government-based packages, reminiscent of Medicare and Medicaid. But that isn’t sufficient to cowl its prices, in keeping with the corporate’s 2017 annual report, which states that DaVita loses cash on every Medicare remedy it supplies. (Medicare covers dialysis for individuals 65 and older, and for youthful sufferers after non-public insurance coverage has offered protection for 30 months.)

Instead, DaVita generates earnings from business well being plans, which it acknowledges pay “significantly higher” charges than authorities packages. The poll measure targets these greater charges, which Dafny describes as “their bread and butter.”

The prospect of the measure passing led DaVita to delay or cancel plans to open new clinics in California regardless of rising affected person demand, Javier Rodriguez, chief government officer of DaVita Kidney Care, informed traders on a call in May, in keeping with the web fairness analysis web site Seeking Alpha.

A few months later, Rodriguez declined to offer a greenback quantity when requested how the initiative would affect the corporate. Rather, he warned traders that it will change into “unsustainable” for the business to deal with the estimated 66,000 dialysis sufferers in California, ought to the measure succeed.

Wall Street analysts agree that Proposition Eight would wipe out DaVita’s earnings in California, in keeping with latest experiences issued by funding corporations J.P. Morgan and Baird. Passing the initiative “would be so devastating,” to the tune of $450 million a yr, that DaVita “would likely walk away from the state altogether,” in keeping with a March Baird report.

DaVita has poured $66.6 million into the opposition marketing campaign as of Oct. 25, and rival Fresenius has contributed $33.6 million. That dwarfs $17.three million in union contributions in help of the measure, in keeping with marketing campaign information filed with California’s secretary of state workplace.

Both Wall Street corporations conclude that Proposition Eight is more likely to fail, citing the business’s huge spending and the union’s file of failure on the polls on different points.

The firm’s authorized troubles don’t fear inventory analysts, both; Baird’s October report on DaVita’s monetary efficiency dedicates simply two sentences to them. It notes that DaVita “is subject to numerous ongoing government investigations and inquiries, similar to most large-scale, high-profile Medicare providers.”

There are not any particular references to the Colorado jury award this summer season, which the corporate is interesting, over the dying of three sufferers who died of cardiac arrest after remedy at DaVita clinics. Nor was there concern about this month’s $270 million settlement over Medicare billing.

That’s as a result of these incidents are seen by traders as the price of doing enterprise — one-time hits that don’t have an effect on an organization’s earnings energy sooner or later, mentioned Matthew Gillmor, a senior analysis analyst at Baird.

“Almost all companies I follow, at some point, have had to pay a fine to the government,” Gillmor mentioned.

Thiry, DaVita’s CEO, acknowledged that settlements, which aren’t good public relations, are a actuality for giant firms, when The Denver Post requested him final yr concerning the firm’s earlier authorized battles.

“If, in a trial, you are found to be wrong on even a small part of the case, it could mean that you are excluded from Medicare, which typically would mean bankruptcy for your company,” Thiry mentioned. “So, you are essentially forced to settle.”

Harriet Rowan of California Healthline contributed to this report.

Use Our Content This story might be republished free of charge (details).

This story was produced by Kaiser Health News, which publishes California Healthline, a service of the California Health Care Foundation.

Samantha Young: [email protected]”>[email protected], @youngsamantha

Related Topics California Health Industry Medicare Colorado src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>