About 1 in 6 Americans have been stunned by a medical invoice after therapy in a hospital in 2017 regardless of having insurance coverage, according to a study revealed Thursday.

On common, 16% of inpatient stays and 18% of emergency visits left a affected person with no less than one out-of-network cost. Most of these got here from medical doctors providing therapy on the hospital, even when the sufferers selected an in-network hospital, in response to researchers from the Kaiser Family Foundation. Its research was based mostly on giant employer insurance coverage claims. (Kaiser Health News is an editorially unbiased program of the inspiration.)

The analysis additionally discovered that when a affected person is admitted to the hospital from the emergency room, there’s the next chance of an out-of-network cost. As many as 26% of admissions from the emergency room resulted in a shock medical invoice.

“Millions of emergency visits and hospital stays left people with large employer coverage at risk of a surprise bill in 2017,” the authors wrote.

The researchers obtained their knowledge by analyzing large-employer claims from IBM’s MarketScan Research Databases, which embrace claims for nearly 19 million people.

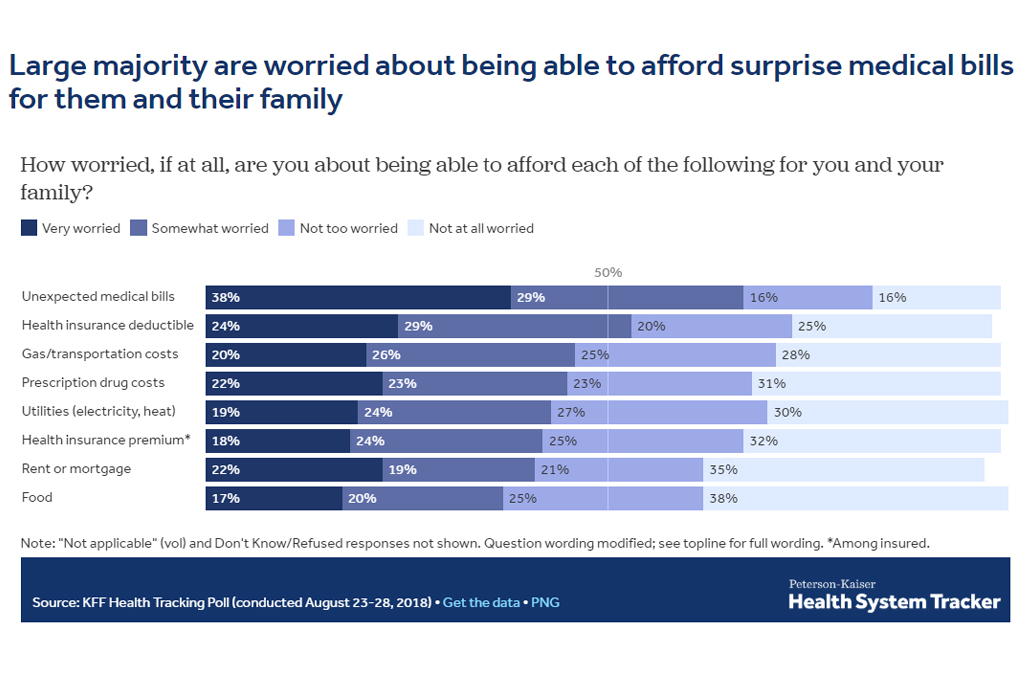

Surprise medical bills are high of thoughts for American sufferers, with 38% reporting they have been “very worried” about sudden medical payments.

Surprise payments don’t simply come from the emergency room. Often, sufferers will decide an in-network facility and see a supplier who works there however isn’t employed by the hospital. These medical doctors, from outdoors staffing companies, can cost out-of-network costs.

“It’s kind of a built-in problem,” stated Karen Pollitz, a senior fellow on the Kaiser Family Foundation and an creator of the research. She stated most personal medical health insurance plans are constructed on networks, the place sufferers get the very best worth for selecting a physician within the community. But sufferers usually don’t know whether or not they’re being handled by an out-of-network physician whereas in a hospital.

“By definition, there are these circumstances where they cannot choose their provider, whether it’s an emergency or it’s [a doctor] who gets brought in and they don’t even meet them face-to-face.”

The subject is ripe for a federal resolution. Some states have surprise-bill protections in place, however these legal guidelines don’t apply to most large-employer plans as a result of the federal authorities regulates them.

“New York and California have very high rates of surprise bills even though they have some of the strongest state statutes,” Pollitz stated. “These data show why federal legislation would matter.”

Consumers in Texas, New York, Florida, New Jersey and Kansas have been the most certainly to see a shock invoice, whereas individuals in Minnesota, South Dakota, Nebraska, Maine and Mississippi noticed fewer, in response to the research.

Legislative options are being mentioned within the White House and Congress. The leaders of the Senate Health, Education, Labor and Pensions Committee launched a bundle Wednesday that included a provision to handle it. The laws from HELP units a benchmark for what out-of-network physicians will probably be paid, which might be an quantity corresponding to what the plan is paying different medical doctors for that service.

That invoice is about for a committee markup subsequent week.

Other remedies are additionally being supplied by totally different teams of lawmakers.