Use Our Content This story could be republished free of charge (details).

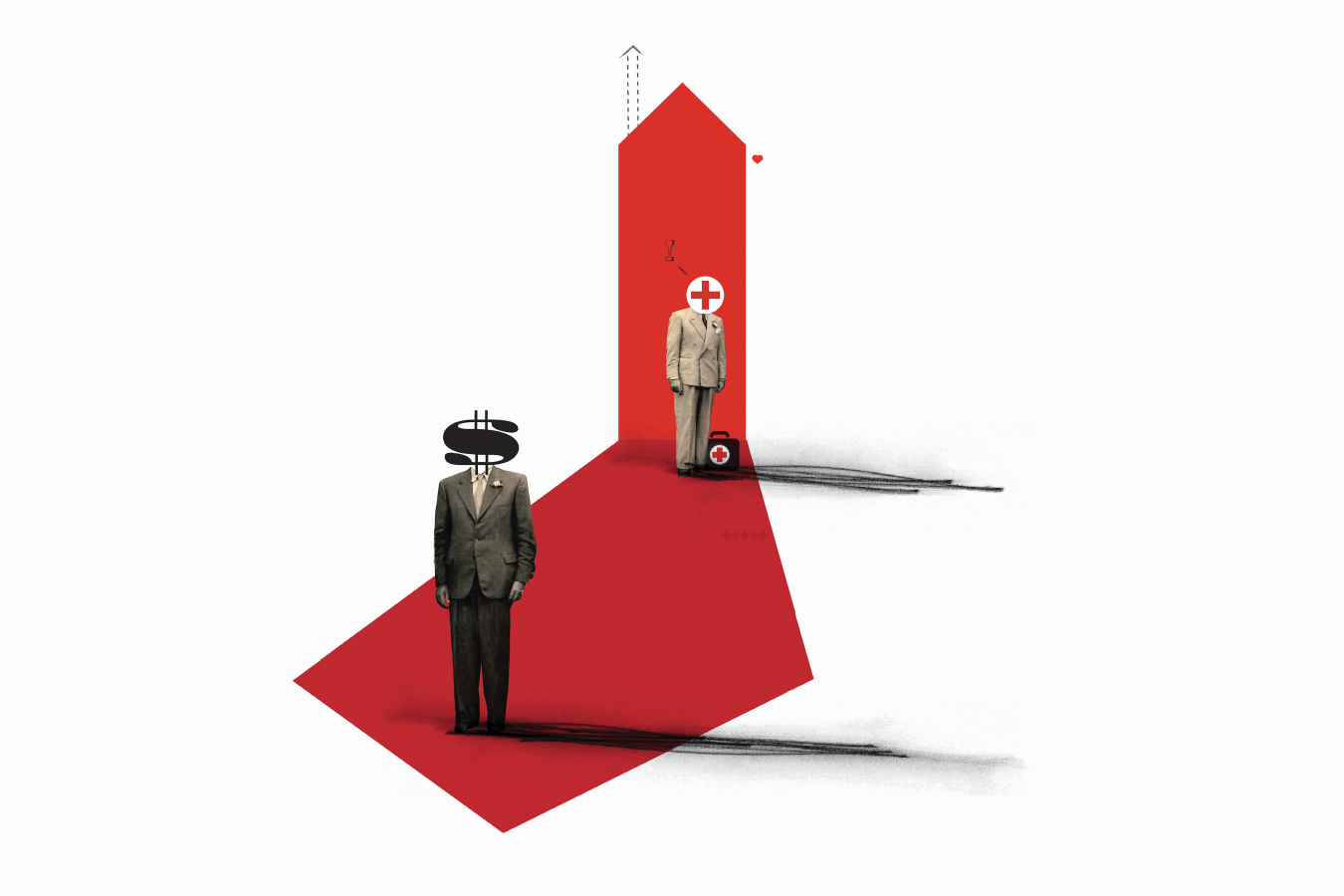

More than two years after California’s surprise-billing regulation took impact, there’s one factor on which shopper advocates, docs and insurers all agree: The regulation has been efficient at defending many individuals from payments they may have been saddled with from docs who aren’t of their insurance coverage community.

But the consensus stops there.

“In general, the law is working as intended,” mentioned Anthony Wright, government director of Health Access California, a affected person advocacy group that pushed for the measure, AB-72. “Patients are protected and the providers are getting paid.”

Physicians beg to vary. They say the regulation’s constraints on what insurers now pay has given the businesses an unfair benefit in negotiations with docs, which is resulting in main adjustments within the business that will have an effect on sufferers.

Recent analyses by some researchers, nevertheless, solid doubt on among the docs’ dire warnings.

“The problem is that AB-72 is creating imbalances in the health care marketplace that are decreasing access to care,” mentioned Dr. Antonio Hernandez Conte, an anesthesiologist whose specialty is amongst these most affected by the regulation.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

The California regulation, which took impact in July 2017, protects shoppers who use an in-network hospital or other facility from being hit with shock payments when cared for by a health care provider who has not contracted with their insurer. If that occurs, shoppers are accountable solely for the copayment or other cost sharing that they’d have owed if that they had been seen by an in-network physician.

Federal lawmakers are eyeing the California regulation as a potential mannequin as they debate legislative proposals that might tackle shock billing on the nationwide stage.

The California regulation applies to nonemergency companies, since most state shoppers have been already protected for emergency care by an earlier courtroom ruling.

It’s common for sufferers who go to a hospital or ambulatory surgical middle that’s coated by their insurance coverage to come across specialists who aren’t, even in nonemergency conditions.

For instance, somebody who has knee substitute surgical procedure with an in-network surgeon at an in-network hospital might not understand that the anesthesiologist and assistant surgeon additionally scrubbing in on the operation will not be.

Or a pair could also be shocked to study that the neonatologist caring for his or her child in intensive care is outdoors their insurance coverage community, regardless that the hospital the place they gave beginning is inside it. Diagnostic specialists like radiologists and pathologists whom sufferers hardly ever see could also be out-of-network at an in-network hospital as properly.

Under the California regulation, the physician’s cost from an insurer in these conditions relies on both the common contracted charge for comparable companies within the space or 125% of what Medicare would have paid, whichever is bigger.

In a California Medical Association on-line survey released last month ― in which 855 physician practices responded ― almost 90% of the docs mentioned that the regulation allowed insurers to shrink doctor networks, thus limiting sufferers’ entry to in-network docs. Physicians blame the brand new regulation’s reimbursement charges for shock out-of-network care. The cost commonplace made insurers much less inclined to barter funds and decreased docs’ bargaining energy, the physicians say.

Those surveyed mentioned they confronted insurer cost charge cuts, refusal to resume their contracts and contract termination, amongst different issues.

This has led some physicians to attempt to acquire leverage by consolidating practices, a transfer that may drive up well being care prices considerably, the docs warn.

The medical affiliation didn’t reply to requires touch upon the survey.

Hernandez Conte, who chairs the legislative and apply affairs division of the California Society of Anesthesiologists, additionally pointed to information from the California Department of Managed Health Care exhibiting that shopper complaints about entry to care have risen from 415 in 2016 to 614 in 2018, a 48% leap.

Those complaints symbolize a minuscule variety of shoppers within the context of the greater than 30 million Californians coated by business insurance coverage or Medi-Cal, mentioned Loren Adler, affiliate director on the University of Southern California-Brookings Schaeffer Initiative for Health Policy. Adler famous that there’s no approach to know if the complaints had something to do with the surprise-billing regulation.

Hernandez Conte additionally pointed to a research printed in August by the analysis agency Rand Corp. that he mentioned confirmed the law is eroding doctors’ leverage with insurers.

But that research ― a collection of 28 interviews with docs and others about their experiences within the first 12 months after the regulation took impact ― wasn’t definitive, mentioned writer Erin Duffy, an adjunct coverage researcher at Rand and postdoctoral fellow on the Schaeffer Center for Health Policy and Economics at USC.

“It’s more a reflection of what are some of the potential things we should look at down the road,” she mentioned.

Aside from particular person examples of contracting issues cited by the doctor group, researchers cite little proof that sufferers are dropping entry to docs who settle for their insurance coverage due to dwindling insurance coverage networks.

The reverse seems to be true. USC-Brookings researchers printed an evaluation in September inspecting greater than 17 million specialty claims by California physicians affected by the regulation. They discovered the share of companies that specialty physicians delivered out-of-network at hospitals and ambulatory surgical facilities declined by 17% after the regulation took impact.

When the regulation went into impact, there was a “precipitous” motion by affected physicians into insurance coverage networks, mentioned Adler, a co-author of the research.

Similarly, when the commerce group America’s Health Insurance Plans surveyed 11 massive California well being insurers about in-network suppliers in the course of the two years after the regulation took impact, it discovered that the numbers grew or remained flat throughout specialties. There was a 16% improve within the variety of in-network physicians total, together with a 26% rise in diagnostic radiologists and an 18% bump in anesthesiologists.

The plight of shoppers who go to an in-network facility and, unbeknownst to them, obtain therapy from out-of-network docs has garnered plenty of attention in current months.

In a typical state of affairs, the physician costs the insurance coverage firm for companies, then turns round and payments the affected person for no matter quantity the insurance coverage firm doesn’t pay, a apply referred to as steadiness billing. With no contract between the insurer and the physician to set cost charges, the quantities billed by physicians are often higher than market rates, and the steadiness payments that sufferers face are many occasions increased than the common copayment they’d owe for in-network care.

Federal lawmakers are debating numerous measures that might tackle the problems on the federal stage. The main House and Senate payments would set minimal cost requirements primarily based on insurers’ median in-network charge for a service for relevant out-of-network care, just like the California regulation.

A federal regulation is vital to broadening the surprise-billing protections offered by California’s regulation, Wright mentioned.

More than half of states now provide some level of consumer protection in opposition to shock payments, and the efforts vary. But state surprise-billing legal guidelines shield only people insured by state-regulated plans. In California, which means 5.5 million consumers whose employers self-fund staff’ well being claims straight, relatively than by an insurance coverage plan, aren’t coated by the regulation.

Since AB-72 was applied, the Department of Managed Health Care hasn’t taken any enforcement actions in opposition to physicians for balance-billing sufferers in nonemergency conditions, in keeping with company spokeswoman Rachel Arrezola. It has pursued a handful of instances in opposition to docs for out-of-network steadiness billing in emergency conditions, nevertheless.

As docs and affected person advocates wrangle over AB-72, lawmakers are urgent new protections for shoppers. A state regulation just lately barred steadiness billing by air ambulance companies.

Starting in January, California shoppers who’re airlifted by an out-of-network air ambulance won’t be responsible for any greater than their common price sharing for in-network suppliers.

Use Our Content This story could be republished free of charge (details).

This KHN story first printed on California Healthline, a service of the California Health Care Foundation.

Michelle Andrews: [email protected]”>[email protected], @mandrews110

Related Topics California Cost and Quality Courts Insurance States California Legislature Doctors Surprise Bills src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>