A invoice pending in California’s legislature to ratchet up oversight of personal fairness investments in well being care is receiving enthusiastic backing from client advocates, labor unions, and the California Medical Association, however drawing heavy hearth from hospitals involved about shedding a possible funding supply.

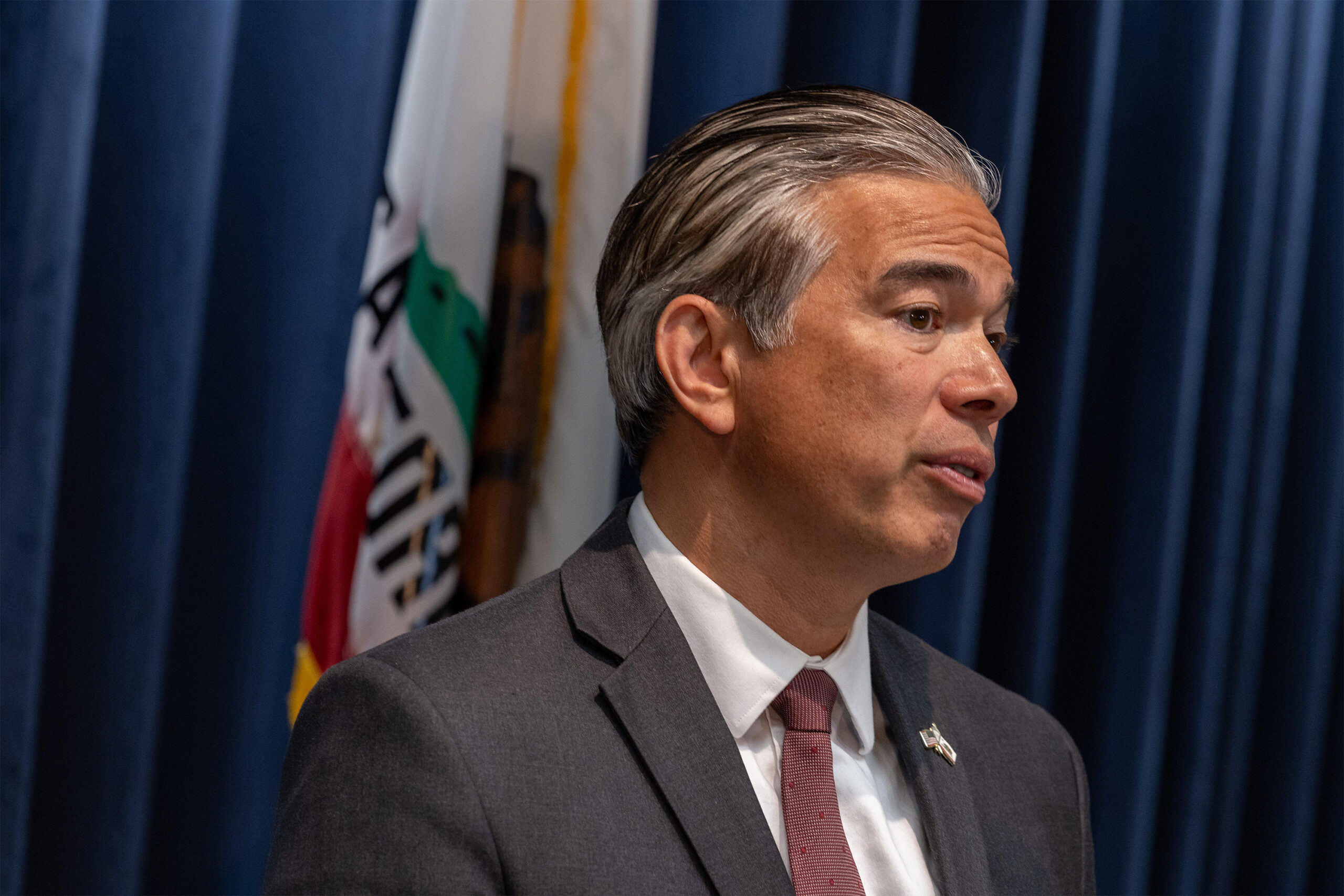

The laws, sponsored by Attorney General Rob Bonta, would require non-public fairness teams and hedge funds to inform his workplace of deliberate purchases of many varieties of well being care companies and procure its consent. It additionally reinforces state legal guidelines that bar nonphysicians from immediately using docs or directing their actions, which is a main purpose for the physician affiliation’s assist.

Private fairness companies elevate cash from institutional buyers similar to pension funds and usually purchase firms they imagine might be run extra profitably. Then they give the impression of being to spice up earnings and promote the property for multiples of what they paid for them.

That might be good for future retirees and generally for mismanaged firms that want a capital infusion and a brand new course. But critics say the profit-first method isn’t good for well being care. Private fairness offers within the sector are coming underneath elevated scrutiny across the nation amid mounting proof that they typically result in increased costs, lower-quality care, and lowered entry to core well being providers.

Opponents of the invoice, led by the state’s hospital affiliation, the California Chamber of Commerce, and a nationwide non-public fairness advocacy group, say it might discourage much-needed funding. The hospital trade has already persuaded lawmakers to exempt gross sales of for-profit hospitals from the proposed legislation.

“We preferred not to make that amendment,” Bonta stated in an interview. “But we still have a strong bill that provides very important protections.”

The laws would nonetheless apply to a broad swath of medical companies, together with clinics, doctor teams, nursing houses, testing labs, and outpatient amenities, amongst others. Nonprofit hospital offers are already topic to the lawyer basic’s assessment.

A remaining vote on the invoice might come this month if a state Senate committee strikes it ahead.

Nationally, non-public fairness buyers have spent $1 trillion on well being care acquisitions prior to now decade, in line with a report by The Commonwealth Fund. Physician practices have been particularly enticing to them, with transactions growing sixfold in a decade and infrequently resulting in vital value will increase. Other varieties of outpatient providers, in addition to clinics, have additionally been targets.

In California, the worth of personal fairness well being care offers grew more than twentyfold from 2005 to 2021, from lower than $1 billion to $20 billion, in line with the California Health Care Foundation. Private fairness companies are monitoring the pending laws carefully however to this point haven’t slowed funding in California, in line with a new report from the analysis agency PitchBook.

Multiple research, in addition to a series of reports by KFF Health News, have documented among the difficulties created by non-public fairness in well being care.

Research published last December within the Journal of the American Medical Association confirmed a bigger chance of antagonistic occasions similar to affected person infections and falls at non-public fairness hospitals in contrast with others. Analysts say extra analysis is required on how affected person care is being affected however that the impression on price is obvious.

“We can be almost certain that after a private equity acquisition, we’re going to be paying more for the same thing or for something that’s gotten worse,” stated Kristof Stremikis, director of Market Analysis and Insight on the California Health Care Foundation.

Most non-public fairness offers in well being care are beneath the $119.5 million threshold that triggers a requirement to notify federal regulators, so that they typically slide underneath the federal government radar. The Federal Trade Commission is stepping up scrutiny, and last year it sued a non-public equity-backed anesthesia group for anticompetitive practices in Texas.

Lawmakers in a number of different states, together with Connecticut, Minnesota, and Massachusetts, have proposed laws that will topic non-public fairness offers to better transparency.

Not all non-public fairness companies are unhealthy operators, stated Assembly member Jim Wood, a Democrat from Healdsburg, however assessment is important: “If you are a good entity, you shouldn’t fear this.”

The invoice would require the lawyer basic to look at proposed transactions to find out their impression on the standard and accessibility of care, in addition to on regional competitors and costs.

Critics observe that non-public fairness offers are sometimes financed with debt that’s then owed by the acquired firm. In many instances, non-public fairness teams sell off real estate to generate fast returns for buyers and the brand new homeowners of the property then cost the acquired firm lease.

That was an element within the monetary collapse of Steward Health Care, a multistate hospital system that was owned by the non-public fairness agency Cerberus Capital Management from 2010 to 2020, according to a report by the Private Equity Stakeholder Project, a nonprofit that helps the California invoice. Steward filed for Chapter 11 chapter in May. “Almost all of the most distressed US healthcare companies are owned by private equity firms,” according to another study by the group.

Opponents of the laws argue it might dampen much-needed funding in an trade with hovering working prices. “Our concern is that it will cut off funding that can improve health care,” stated Ned Wigglesworth, a spokesperson for Californians to Protect Community Health Care, a coalition of teams combating the laws. The prospect of getting to undergo a prolonged assessment by the lawyer basic, he stated, would create “a chilling effect on private funders.”

Proponents of personal fairness funding level to what they are saying are notable successes in California well being care.

Children’s Choice Dental Care, for instance, stated in a letter to state senators that it logs over 227,000 dental visits yearly, largely with youngsters on Medi-Cal, the medical health insurance program for low-income Californians. “We have been able to expand to 25 locations, because we have been able to access capital from a private equity firm,” the group wrote.

Ivy Fertility, with clinics in California and eight different states, stated in a letter to state senators that non-public funding has expanded its potential to offer fertility therapies at a time when demand for them is growing.

Researchers observe that non-public fairness buyers are hardly alone in terms of well being care profiteering, which extends even to nonprofits. Sutter Health, a significant nonprofit hospital chain, for instance, settled for $575 million in a lawsuit brought by then-Attorney General Xavier Becerra, for unfair contracting and pricing.

“It’s helpful to look at ownership classes like private equity, but at the end of the day we should look at behavior, and anyone can do the things that private equity firms do,” stated Christopher Cai, a doctor and well being coverage researcher at Harvard Medical School. He added, although, that non-public fairness buyers are “more likely to engage in financially risky or purely profit-driven behavior.”

This article was produced by KFF Health News, which publishes California Healthline, an editorially impartial service of the California Health Care Foundation.

Bernard J. Wolfson:

[email protected],

@bjwolfson

Related Topics

src=”//platform.twitter.com/widgets.js” charset=”utf-8″>