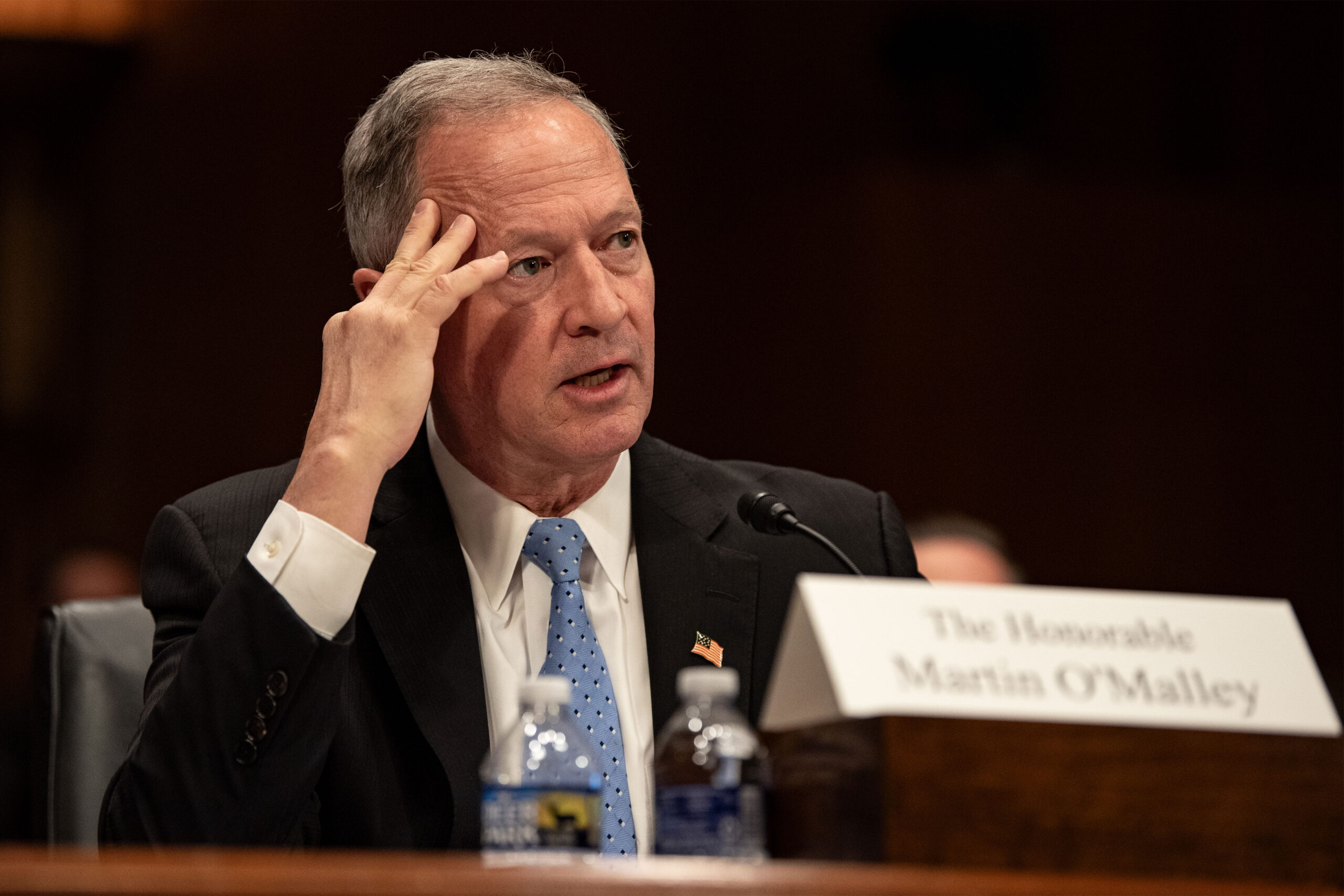

In March, newly put in Social Security chief Martin O’Malley criticized agency “injustices” that “shock our shared sense of equity and good conscience as Americans.”

He promised to overtake the Social Security Administration’s often heavy-handed efforts to claw again cash that millions of recipients — together with people who find themselves residing in poverty, are aged, or have disabilities — had been allegedly overpaid, as described by a KFF Health News and Cox Media Group investigation final yr.

“Innocent people can be badly hurt,” O’Malley mentioned on the time.

Nearly eight months since he appeared before Congress and introduced a collection of coverage modifications, and with two months left in his time period, O’Malley’s effort to repair the system has made inroads however stays a piece in progress.

For occasion, one change, shifting away from withholding 100% of individuals’s month-to-month Social Security advantages to recuperate alleged overpayments, has been a significant enchancment, say advocates for beneficiaries.

“It is a tremendous change,” mentioned Kate Lang of Justice in Aging, who referred to as it “life-changing for many people.”

The variety of individuals from whom the Social Security Administration was withholding full month-to-month advantages to recoup cash declined sharply — from about 46,000 in January to about 7,000 in September, the company mentioned.

Asked to make clear whether or not these numbers and others supplied for this text lined all packages administered by the company, the SSA press workplace didn’t reply.

Another probably vital change — relieving beneficiaries of getting to show that an overpayment was not their fault — has not been carried out. The company mentioned it’s engaged on that.

Meanwhile, the company appears to be trying to Congress to take the lead on a change some observers see as essential: limiting how far again the federal government can attain to recuperate an alleged overpayment.

Barbara Hubbell of Watkins Glen, New York, referred to as the absence of a statute of limitations “despicable.” Hubbell mentioned her mom was held responsible for $43,000 due to an SSA error going again 19 years.

“In what universe is that even legal?” Hubbell mentioned. Paying down the overpayment steadiness left her mom “essentially penniless,” she added.

In response to questions for this text, Social Security spokesperson Mark Hinkle mentioned laws is “the best and fastest way” to set a time restrict.

Establishing a statute of limitations was not among the many coverage modifications O’Malley introduced in his March congressional testimony. In an interview on the time, he mentioned he anticipated an announcement on it “within the next couple few months.” It might in all probability be executed by regulation, with out an act of Congress, he mentioned.

Speaking usually, Hinkle mentioned the company has “made substantial progress on overpayments,” lowering the hardship they trigger, and “continues to work diligently” to replace insurance policies.

The company is underfunded, he added, is at a close to 50-year low in staffing, and will do higher with extra workers. The SSA didn’t reply to requests for an interview with O’Malley.

O’Malley introduced the coverage modifications after KFF Health News and Cox Media Group collectively revealed and broadcast investigative reporting on the harm overpayments and clawbacks have executed to tens of millions of beneficiaries.

When O’Malley, a former Democratic governor of Maryland, introduced his plans to a few congressional committees in March, lawmakers greeted him with uncommon bipartisan reward. But the previous a number of months have proven how onerous it may be to show round a federal forms that’s large, advanced, deeply dysfunctional, and, because it says, understaffed.

Now O’Malley’s time could also be working out.

Lang of Justice in Aging, among the many advocacy teams which have been assembly with O’Malley and different Social Security officers, mentioned she appreciates how a lot the commissioner has achieved in a short while. But she added that O’Malley has “not been interested in hearing about our feelings that things have fallen short.”

One long-standing coverage O’Malley got down to change includes the burden of proof. When the Social Security Administration alleges somebody has been overpaid and calls for the cash again, the burden is on the beneficiary to show they weren’t at fault.

Cecilia Malone, 24, a beneficiary in Lithonia, Georgia, mentioned she and her mother and father spent tons of of hours making an attempt to get errors corrected. “Why is the burden on us to ‘prove’ we weren’t overpaid?” Malone mentioned.

It might be exceedingly troublesome for beneficiaries to attraction a choice. The alleged overpayments, which might attain tens of hundreds of {dollars} or extra, typically span years. And individuals struggling simply to outlive could have further problem producing monetary data from way back.

What’s extra, in letters demanding reimbursement, the federal government doesn’t sometimes spell out its case towards the beneficiary — making it onerous to mount a protection.

Testifying earlier than House and Senate committees in March, O’Malley promised to shift the burden of proof.

“That should be on the agency,” he mentioned.

The company expects to finalize “guidance” on the topic “in the coming months,” Hinkle mentioned.

The company factors to diminished wait instances and different enhancements in a telephone system identified to go away beneficiaries on maintain. “In September, we answered calls to our national 800 number in an average of 11 minutes — a tremendous improvement from 42 minutes one year ago,” Hinkle mentioned.

Still, in response to a nonrepresentative survey by KFF Health News and Cox Media Group targeted on overpayments, about half of respondents who mentioned they contacted the company by telephone since April rated that have as “poor,” and few rated it “good” or “excellent.”

The survey was despatched to about 600 individuals who had contacted KFF Health News to share their overpayment stories since September 2023. Almost 200 individuals answered the survey in September and October of this yr.

Most of those that mentioned they contacted the company by mail since April rated their expertise as “poor.”

Jennifer Campbell, 60, a beneficiary in Nelsonville, Ohio, mentioned in late October that she was nonetheless ready for somebody on the company to comply with up as described throughout a telephone name in May.

“VERY POOR customer service!!!!!” Campbell wrote.

“Nearly impossible to get a hold of someone,” wrote Kathryn Duff of Colorado Springs, Colorado, who has been serving to a disabled member of the family.

Letters from SSA have left Duff mystified. One was postmarked July 9, 2024, however dated greater than two years earlier. Another, dated Aug. 18, 2024, mentioned her member of the family was overpaid $31,635.80 in advantages from the Supplemental Security Income program, which gives cash to individuals with little or no income or different assets who’re disabled, blind, or no less than 65. But Duff mentioned her relative by no means acquired SSI advantages.

What’s extra, for the dates in query, funds listed within the letter to again up the company’s math didn’t come near $31,635.80; they totaled a few quarter of that quantity.

Regarding the 100% clawbacks, O’Malley in March mentioned it’s “unconscionable that someone would find themselves facing homelessness or unable to pay bills, because Social Security withheld their entire payment for recovery of an overpayment.”

He mentioned that, beginning March 25, if a beneficiary doesn’t reply to a brand new overpayment discover, the company would default to withholding 10%. The company warned of “a short transition period.”

That change wasn’t automated till June 25, Hinkle mentioned.

The variety of individuals newly positioned in full withholding plummeted from 6,771 in February to 51 in September, based on information the company supplied.

SSA mentioned it might notify recipients they might request diminished withholding if it was already clawing again greater than 10% of their month-to-month checks.

Nonetheless, dozens of beneficiaries or their relations instructed KFF Health News and Cox Media Group they hadn’t heard they might request diminished withholding. Among those that did ask, roughly half mentioned their requests had been accepted.

According to the SSA, there was virtually a 20% decline within the variety of individuals going through clawbacks of greater than 10% however lower than 100% of their month-to-month checks — from 141,316 as of March 8 to 114,950 as of Oct. 25, company spokesperson Nicole Tiggemann mentioned.

Meanwhile, the variety of individuals from whom the company was withholding precisely 10% soared greater than fortyfold — from simply over 5,000 to nicely over 200,000. And the variety of beneficiaries having any partial advantages withheld to recuperate an overpayment elevated from virtually 600,000 to virtually 785,000, based on information Tiggemann supplied.

Lorraine Anne Davis says she hasn’t acquired her month-to-month Social Security fee since June because of an alleged overpayment. Her Medicare premium was being deducted from her month-to-month profit, so she has been left to pay that out-of-pocket.(The Davis household)

Lorraine Anne Davis, 72, of Houston, mentioned she hasn’t acquired her month-to-month Social Security fee since June because of an alleged overpayment. Her Medicare premium was being deducted from her month-to-month profit, so she’s been left to pay that out-of-pocket.

Davis mentioned she’s going to wish a kidney transplant and had been making an attempt to save cash for when she’d be unable to work.

A letter from the SSA dated April 8, 2024, two weeks after the brand new 10% withholding coverage was slated to take impact, mentioned it had overpaid her $13,538 and demanded she pay it again inside 30 days.

Apparently, the SSA hadn’t accounted for a pension Davis receives from abroad; Davis mentioned she disclosed it when she filed for advantages.

In a letter to her dated June 29, the company mentioned that, beneath its new coverage, it might change the withholding to solely 10% if she requested.

Davis mentioned she requested by telephone repeatedly, and to no avail.

“Nobody seems to know what’s going on” and “no one seems to be able to help you,” Davis mentioned. “You’re just held captive.”

In October, the company mentioned she’d obtain a fee — in March 2025.

Marley Presiado, a analysis assistant on the Public Opinion and Survey Research crew at KFF, contributed to this report.

Do you’ve gotten an expertise with Social Security overpayments you’d wish to share? Click here to contact our reporting crew.

[Clarification: This article was revised at 9 a.m. ET on Nov. 18, 2024, to add the word “partial” in this sentence: “And the number of beneficiaries having any partial benefits withheld to recover an overpayment increased from almost 600,000 to almost 785,000, according to data Tiggemann provided.”]

David Hilzenrath:

[email protected],

@DavidHilzenrath

Jodie Fleischer, Cox Media Group:

@jodieTVnews

Related Topics

src=”//platform.twitter.com/widgets.js” charset=”utf-8″>