Jackie Fortiér and Oona Zenda

Illustrations by Oona Zenda

“My son was diagnosed with congenital CMV, a virus that can cause hearing loss. As part of this diagnosis, he will be required to have routine hearing tests every few months until he is 10 years old. I reached out to you because I wanted to know why my son’s hearing tests weren’t covered by our insurance and why we needed to pay for it.”

— Anna Deutscher, 29, from Minnesota, writing about her toddler son, Beckham

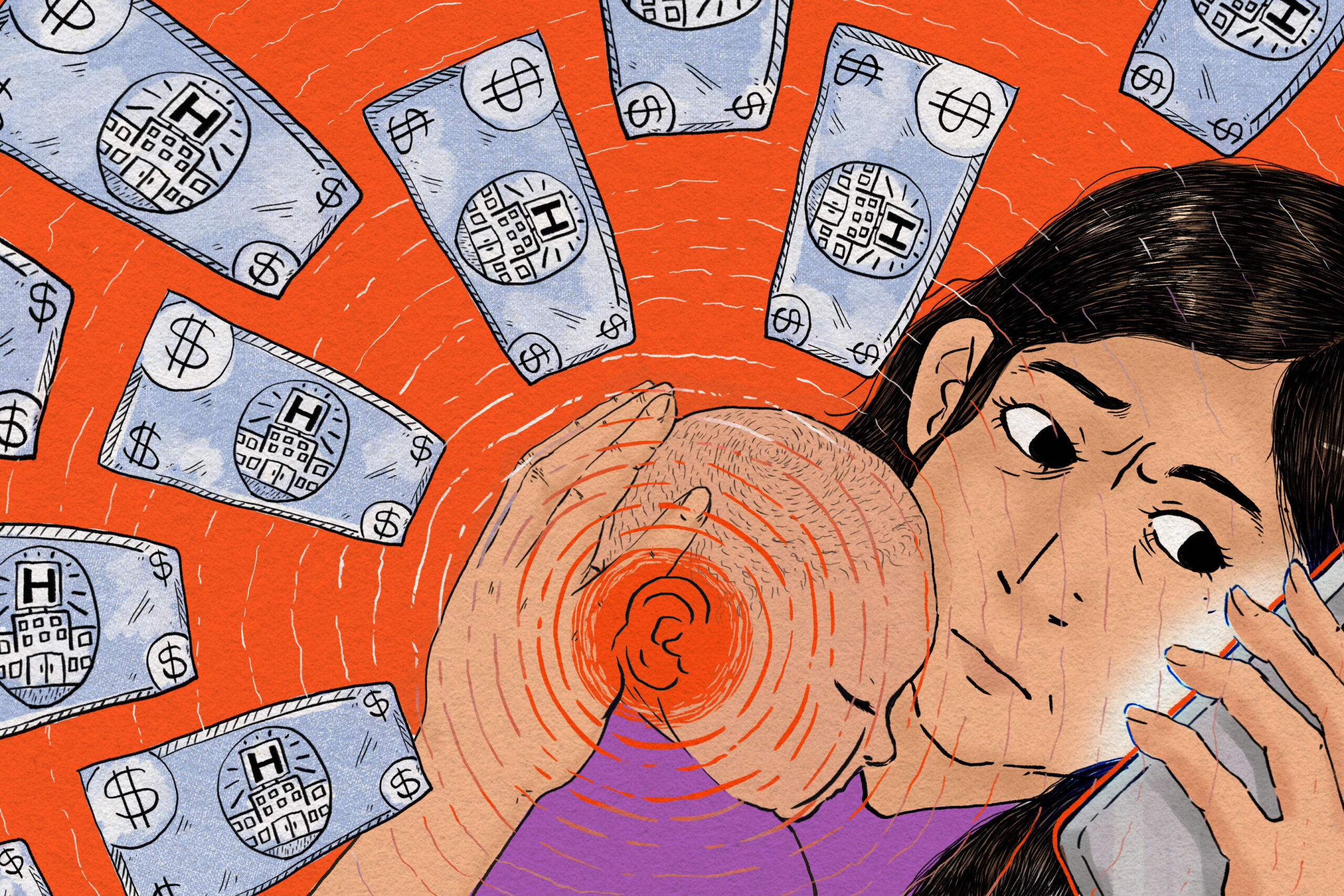

Trying to determine why her declare was denied took Anna Deutscher lots of time and work.

Baby Beckham’s listening to screenings have been preventive care, which is meant to be lined by legislation. Every listening to take a look at value them about $350 out-of-pocket. Between these payments and Beckham’s different well being prices, the household maxed out two bank cards.

“Everything just immediately goes right to trying to pay that debt off,” Deutscher mentioned.

At occasions, she felt overwhelmed by her son’s medical wants, on high of working. Deutscher mentioned she “didn’t know what else to do” when her insurance coverage firm saved saying no to her requests that it pay for the listening to checks.

No one desires to spend time combating their medical insurance firm. Many folks really feel they don’t have the information or stamina to do it. But if, like Deutscher, you’re denied for a preventive service, it could be value it.

Here are a number of suggestions — a slingshot and some stones, so that you may be David when dealing with a well being care Goliath.

1. Check Your Policy

Read your plan paperwork to substantiate whether or not the therapy or service is roofed. Pay consideration to any exclusions or limitations. Deutscher’s plan paperwork say listening to checks are usually not lined. But even when a sought-after profit is excluded, which may not be the top of the road.

2. Is the Service Preventive?

Many kinds of preventive care are alleged to be lined with out further value underneath the Affordable Care Act. If you obtain a advisable preventive screening and have non-public insurance coverage, together with by means of the Affordable Care Act market, there needs to be no copayment on the time of service, and also you shouldn’t get a invoice later. A small variety of insurance policy are “grandfathered in,” which implies chances are you’ll not have the identical rights and protections because the ACA offers. Check together with your employer’s human assets advantages supervisor to search out out for certain.

Here’s a list of preventive services well being plans should cowl and the list particular to kids and younger adults.

A doctor advisable common listening to screenings for the Deutschers’ child, which the healthcare.gov listing signifies needs to be thought-about preventive and lined by insurance coverage. But JoAnn Volk, an insurance coverage skilled and a analysis professor at Georgetown University, mentioned actual life usually doesn’t match what the legislation requires.

“It really does come down to everyone sort of being on their best behavior on the provider and plan side to truly interpret and follow what should be covered,” Volk mentioned.

3. Peel Apart the Denial

If you’ve been denied protection, it’s worthwhile to know why. Health insurance coverage firms are required to clarify each denial. The denial letter or your clarification of advantages ought to state the rationale, which can be a protection exclusion, incorrect coding, or a willpower that the service was deemed not medically mandatory. Follow up and ask for particular particulars concerning the denial and the standards used, and request an evidence of advantages. Then use that info to build an appeal, being certain to handle the rationale for the denial.

4. File the Appeal

There are a number of steps to know, however you don’t must be a lawyer to determine them out. Usually there’s an attraction kind to fill out. Visit your insurer’s web site, examine your clarification of advantages, or name your insurer and ask learn how to get began. The course of sometimes consists of writing a letter saying why you disagree with the denial. Include any medical data or take a look at outcomes that help your case and a duplicate of the federal tips that present the care is a lined, preventive service. If you may, ask your doctor to write down a letter explaining why the service is preventive and mandatory.

Your insurance coverage firm has 30 to 60 days to reply, relying in your state and well being plan. If your attraction is denied, attempt once more. Some folks win on the second go-round.

If your attraction is denied a second time, you may request an external medical review. That course of is led by a medical skilled who is meant to make an unbiased choice. In California, as an illustration, many well being plans fall underneath the jurisdiction of the Department of Managed Health Care.

“In 2023, 72% of health plan members that came to us and filed an independent medical review ended up getting the service that they requested,” mentioned Mary Watanabe, who leads the division.

Keep deadlines in thoughts. How a lot time it’s important to file needs to be in your clarification of advantages. Your insurer is required by legislation to just accept the exterior reviewer’s choice.

For extra assist beginning an attraction or asking for an exterior overview, go to healthcare.gov or your state insurance department.

5. Ask Human Resources for Help

If you get protection by means of your job and also you’re hitting roadblocks, contemplate emailing your human assets division. HR of us have contacts with the insurance coverage firms you don’t and will prevent a number of calls to the 800 quantity on the again of your insurance coverage card. Legally, HR is underneath no obligation to assist, and masking a well being service is probably not in your employer’s monetary curiosity. But sending HR the paperwork you ready for the insurance coverage attraction could immediate them to push the insurance coverage firm to take one other look.

“The whole point of employers offering benefits is to attract and retain a solid workforce, right?” Volk mentioned.

Making a case to HR could also be a ramp towards getting the therapy or service lined the following time your organization revises its well being plan choices, mentioned Rhonda Buckholtz, a guide who advises companies on medical billing.

She mentioned shoppers can do a fast on-line search to see whether or not different massive insurance coverage firms of their space cowl the well being care service they want. That info can provide you leverage, Buckholtz mentioned.

Going to HR helped Deutscher. Eventually, her employer mentioned it might cowl the price of listening to checks for child Beckham for the present plan yr. Deutscher’s employer has a self-funded plan, which supplies firms the flexibility to customise advantages. It finally determined so as to add listening to checks as a typical profit for all staff.

“It’s been like this constant cloud hanging over my head, so for that to suddenly be lifted, it didn’t feel real. I also have never gone to my HR for something like this before. I didn’t even know this was an option,” Deutscher mentioned.

Health Care Helpline helps you navigate the well being system hurdles between you and excellent care. Send us your difficult query and we could faucet a coverage sleuth to puzzle it out. Share your story. The crowdsourced mission is a joint manufacturing of NPR and KFF Health News.