Rachael Norman wanted to submit a pile of out-of-network medical payments to her insurance coverage firm for reimbursement. Short on time, she began looking out for a corporation that would do this tedious work for her.

She failed to search out one, so she began one herself.

Norman mentioned her firm, Better, together with a handful of different Silicon Valley start-ups, is trying to usher medical billing know-how into the 21st century. Banking, transportation, furnishings and grocery buying can all be managed with some fancy finger work on smartphone screens. She and different entrepreneurs puzzled: Why not medical payments?

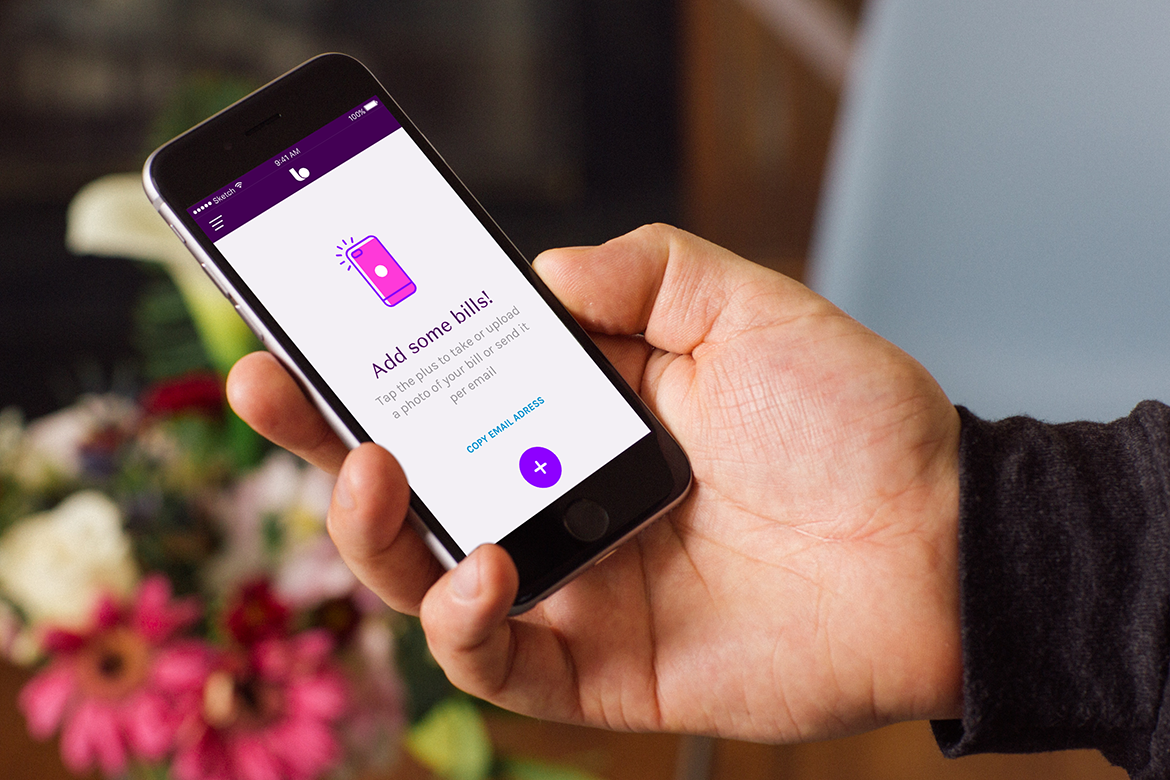

Today, Norman’s purchasers submit digital copies of their out-of-network payments via an app on their telephones. Better’s workers navigate the bureaucratic thicket to trace down reimbursements — and hold 10 p.c of the cash they get better from insurers.

The firm has processed hundreds of thousands of dollars in claims, for every thing from psychiatry to acupuncture to contact lenses, Norman mentioned. The majority of Better’s clients have Preferred Provider Organizations (PPOs) or different varieties of insurance coverage insurance policies with out-of-network advantages. Unlike visiting in-network docs, sufferers utilizing out-of-network providers typically should pay upfront, then ask for reimbursement from their insurer later.

“For a lot of people, it becomes magic that we’re able to solve those problems and get them the money they are owed from insurance,” mentioned Norman, who based Oakland-based Better a few yr and a half in the past.

Better is amongst a brand new breed of start-ups attempting to guide clients via the labyrinth of medical billing. Each has taken on a distinct facet of billing — serving to sufferers file claims, scanning payments for errors or making prices simpler to grasp.

But of their quest to revolutionize an trade, these start-ups face a wide range of obstacles, together with bother having access to medical information and problem cracking complicated insurance coverage insurance policies. Some of the younger firms are flourishing. Others are folding.

Pairing a technological answer with an trade that also makes use of faxes, distant name facilities and snail-mailed payments can show difficult. “You can’t automate repeated phone calls to a guy in a basement who doesn’t want to do his job,” mentioned Victor Echevarria, whose firm, Remedy Labs, folded two years after he based it.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

The emergence of those companies displays the truth that medical billing is a sophisticated, typically byzantine course of that may mystify even the savviest customers. Adding insult, these payments typically begin to pile up whereas patients are still at their lowest — both coping with critical medical points, or simply starting to get better.

Kristin-Leigh Brezinski, who works for a small tech firm in Seattle, mentioned she began utilizing Better to handle a pile of remedy payments she’d been that means to submit for reimbursement. She had postpone the duty partly as a result of she knew it could be a headache to spend hours on interminable telephone calls, she mentioned.

“I didn’t really want to sit on hold for the rest of my life,” mentioned Brezinski, 28. She preferred Better’s service a lot that she continues to make use of it and has advisable it to others.

Experts agree that buyers need assistance tackling pricey and sophisticated medical payments.

“Medical problems and medical bills are very likely to be the straw that breaks the camel’s back of a family’s finances,” mentioned Anthony Wright, government director of Health Access California, a well being care shopper advocacy group.

Wright mentioned the Affordable Care Act offered some safety for folks, equivalent to banning annual and lifelong limits on protection and capping out-of-pocket maximums.

Many states, together with California, have additionally adopted consumer protections against surprise medical bills. These are the customarily pricey prices customers obtain from out-of-network suppliers, despite the fact that they went to an in-network facility.

Despite these advances, Wright mentioned many facets of medical billing stay a significant downside for customers. He thinks apps may assist sufferers navigate sure points, however coverage fixes may very well be much more efficient.

For instance, an app might notify customers once they’ve hit their annual out-of-pocket most, however the state might merely require insurers to supply that discover, negating the necessity for the app.

“I would love to put in place some laws and consumer protections that make some of these apps obsolete,” Wright mentioned.

The panorama isn’t essentially pleasant to medical billing start-ups, as Echevarria found after he based San Francisco-based Remedy Labs two years in the past.

He was impressed to deal with the issue of medical overbilling after his toddler son needed to go to the emergency room for a fever-related seizure and his household incurred about $12,000 dollars in medical payments, lots of them laced with errors.

Co-founder Marija Ringwelski had checked out her personal payments and located errors about 80 p.c of the time. The two determined to construct a platform just like Credit Karma, the favored credit score and monetary administration platform that gives a free credit score rating and free credit score monitoring. Only this one can be for medical payments.

“Everybody wanted that product,” Echevarria mentioned. “They wanted the medical bill version of identity protection.”

Using new know-how and a group of consultants that scrutinized purchasers’ medical payments looking for errors, Remedy ultimately discovered methods to function effectively in all methods however one, Echevarria mentioned: While sufferers had a authorized proper to their very own medical info, many billing places of work refused handy it over to 3rd events.

“The industry operates in a way that is decades old,” he mentioned. While numerous the operation may very well be automated, a few of it stays frustratingly hands-on and time-intensive, he mentioned.

The downside proved insurmountable, and the corporate went out of enterprise this previous summer season.

Even if firms handle to get their fingers on required medical information, insurance coverage insurance policies are extraordinarily difficult and may be tough to navigate, mentioned Betsy Imholz, particular tasks director for Consumers Union.

Rules differ amongst firms, and rules amongst states, she mentioned. To assist a person, firms should comb via piles of paperwork and determine every buyer’s particular scenario. As Remedy’s expertise illustrates, that course of can’t at all times be achieved with easy know-how.

There’s additionally a advertising downside: Many customers “don’t realize there’s help to be had,” mentioned Mark Hall, director of the Health Law and Policy Program at Wake Forest University’s School of Law.

Palo Alto-based Simplee addressed a few of these challenges by shifting its enterprise mannequin.

Rather than straight serving customers — because it did when it was a brand new start-up seven years in the past — Simplee now markets its software program to hospitals. Its purchasers at present embrace greater than 400 hospitals and greater than 2,000 clinics.

The software program provides sufferers entry to all of their payments in a single place and makes an attempt to make prices simpler for them to grasp. It additionally permits sufferers to see detailed explanations of prices and to create fee plans when mandatory, mentioned John Adractas, the corporate’s chief industrial officer.

“It’s not like there’s one formula for how to tackle health care problems,” Adractas mentioned.

This story was produced by Kaiser Health News, which publishes California Healthline, a service of the California Health Care Foundation.

Related Topics California Healthline Cost and Quality Health IT