This story additionally ran on NPR. This story will be republished at no cost (details).

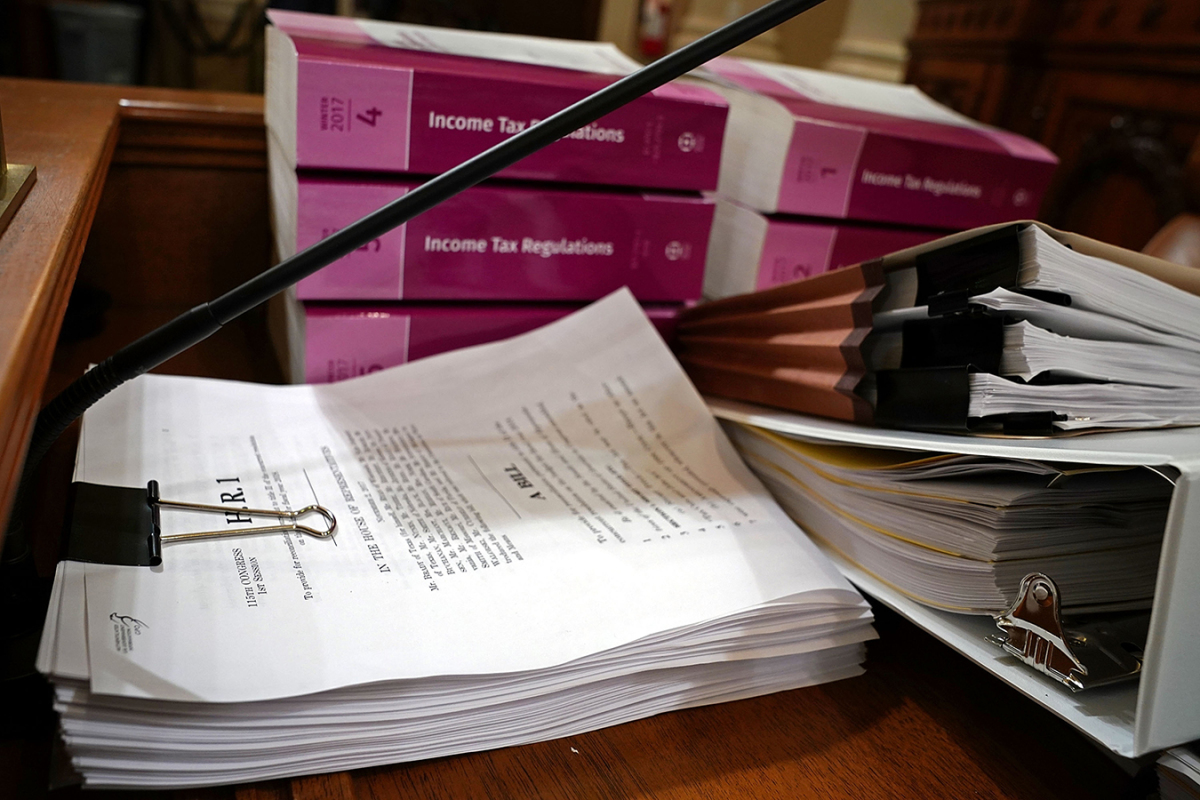

Having didn’t repeal and change the Affordable Care Act, Congress is now engaged on a tax overhaul. But it seems the tax payments within the House and Senate additionally goal to reshape well being care.

Here are 5 massive methods the tax invoice may have an effect on well being coverage:

1. Repeal the requirement for most individuals to have medical health insurance or pay a tax penalty.

Republicans tried and failed to finish the so-called particular person mandate this yr once they tried to advance their well being overhaul laws. Now the concept is again, a minimum of within the Senate’s model of the tax invoice. The measure wouldn’t technically take away the requirement for individuals to have insurance coverage, however it might remove the positive individuals would face in the event that they select to stay uninsured.

The Congressional Budget Office has estimated that dropping the requirement would end in 13 million fewer individuals having insurance coverage over 10 years.

It additionally estimates that premiums would rise 10 % extra per yr than they might with out this transformation. That is as a result of more healthy individuals can be most probably to drop insurance coverage within the absence of a positive, so insurers must elevate premiums to compensate for a sicker group of consumers. Those shoppers, in flip, can be left with fewer inexpensive decisions, in response to the CBO.

State insurance coverage officers are involved that insurers will drop out of the person market completely if there isn’t a requirement for wholesome individuals to enroll, however they nonetheless need to promote to individuals who know they’ll want medical care.

Ironically, the states most probably to see this type of insurance-market disruption are these which might be reliably Republican. An evaluation by the Los Angeles Times steered that the states with the fewest insurers and the very best premiums — together with Alaska, Iowa, Missouri, Nebraska, Nevada, and Wyoming — can be those left with both no protection choices or choices too costly for many shoppers within the particular person market.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

2. Repeal the medical expense deduction.

The House-passed tax invoice, though not the Senate’s, would remove taxpayers’ capacity to deduct medical bills that exceed 10 % of their adjusted gross revenue.

The medical expense deduction will not be extensively used — just below 9 million tax filers took it on their 2015 tax returns, in response to the Internal Revenue Service. But those that do use it usually have very excessive medical bills, typically for a disabled little one, a critical power sickness or costly long-term care not lined by medical health insurance.

Among these most vehemently towards eliminating the deduction is the senior advocacy group AARP. Eliminating the deduction, the group stated in an announcement, “amounts to a health tax on millions of Americans with high medical costs — especially middle income seniors.”

three. Trigger main cuts to the Medicare program.

The tax payments embrace no particular Medicare adjustments, however finances analysts level out that passing it in its present type would set off one other legislation to kick in. That measure requires cuts to federal packages if the federal finances deficit is elevated.

Because the tax payments in each the House and Senate would add an extra $1.5 trillion to the deficit over the following 10 years, each would end in automated cuts underneath the Statutory Pay-As-You-Go Act of 2010, referred to as PAYGO. According to the CBO, if Congress passes the tax invoice and doesn’t waive the PAYGO legislation, federal officers “would be required to issue a sequestration order within 15 days of the end of the session of Congress to reduce spending in fiscal year 2018 by the resultant total of $136 billion.”

Cuts to Medicare are restricted underneath the PAYGO legislation, so the Medicare discount can be restricted to four % of program spending, which is roughly $25 billion of that complete. Cuts of an identical measurement can be required in future years. Most of that may possible come from funds to suppliers.

four. Change tax remedy for graduate college students and people paying again pupil loans.

The House invoice, although not the Senate’s, would for the primary time require graduate college students to pay tax on the worth of tuition that universities don’t require them to pay.

Currently, graduate college students in lots of fields, together with science, typically are paid a small stipend for instructing whereas they pursue superior levels. Many are technically charged tuition, however it’s “waived” so long as they’re working for the college.

The House tax invoice would remove that waiver and require them to pay taxes on the complete worth of the tutoring they don’t need to pay, which might end in many college students with pretty low incomes seeing very giant tax payments.

At the identical time, the House tax invoice would remove the deduction for curiosity paid on pupil loans. This would disproportionately have an effect on younger docs.

According to the Association of American Medical Colleges, 75 % of the medical faculty class of 2017 graduated with pupil mortgage debt, with practically half owing $200,000 or extra.

5. Change or remove the tax credit score that encourages pharmaceutical firms to develop medicine for uncommon illnesses.

Congress created the so-called Orphan Drug Credit in 1983, as a part of a bundle of incentives meant to entice drugmakers to check and develop medicine to deal with uncommon illnesses, outlined as these affecting fewer than 200,000 individuals. With such a small potential market, it doesn’t in any other case make monetary sense for the businesses to spend the thousands and thousands of dollars essential to develop remedies for such illnesses.

To date, about 500 medicine have come to market utilizing the incentives, though in some instances drugmakers have manipulated the credit score for further monetary achieve.

The House tax invoice would remove the tax credit score; the Senate invoice would scale it again. Sen. Orrin Hatch (R-Utah), chairman of the tax-writing Finance Committee, is likely one of the authentic sponsors of the orphan drug legislation.

The drug business has been comparatively quiet concerning the potential lack of the credit score, however the National Organization for Rare Disorders referred to as the change “wholly unacceptable” and stated it “would straight end in 33 % fewer orphan medicine coming to market.“

Julie Rovner: [email protected]”>[email protected], @jrovner

Related Topics Cost and Quality Insurance Medicare Pharmaceuticals Repeal And Replace Watch The Health Law Legislation Orphan Drugs Premiums Tax Penalties U.S. Congress src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>