Use Our Content This story may be republished without spending a dime (details). Most Americans are proud of the insurance coverage they purchase on the person market, but those self same individuals suppose the markets are collapsing earlier than their eyes.

A poll by the Kaiser Family Foundation, launched Tuesday, discovered that 61 % of individuals enrolled in market plans are happy with their insurance coverage selections and majority say they aren’t paying extra this 12 months in contrast with final 12 months’s premium prices.

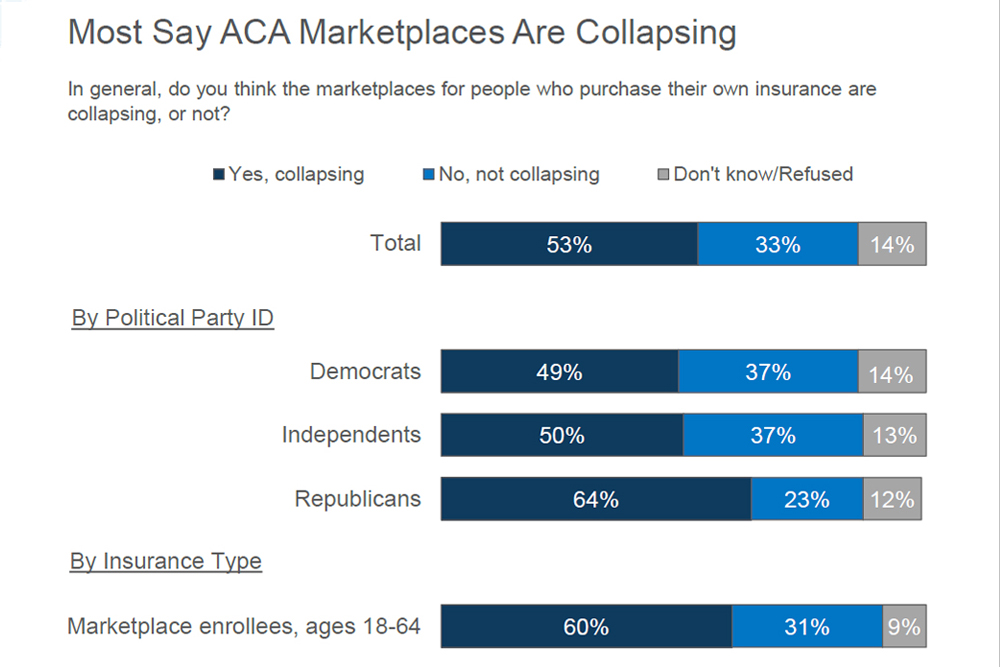

Yet, greater than half of the general public — 53 % — additionally suppose the Affordable Care Act’s marketplaces are “collapsing.” (Kaiser Health News is an editorially unbiased program of the muse.)

Experts have warned that some coverage actions supported by the Trump administration would undermine the market, together with repealing the penalty for going with out insurance coverage and giving individuals the choice to purchase short-term plans. Such plans are sometimes cheaper however cowl fewer advantages. They usually are not mechanically renewable, and insurers are capable of cost individuals with medical circumstances extra — or exclude them altogether.

But solely about one-fifth of people that get hold of protection on the person market have been even conscious that the mandate penalty had been repealed as of 2019, in response to the ballot. It remains to be in impact this 12 months.

Nine in 10 enrollees stated they might nonetheless purchase insurance coverage with out the penalty, and 34 % stated the mandate was a “major reason” they selected to purchase insurance coverage in any respect.

“They may have been prompted to buy the coverage in the first place because of the mandate,” stated Sabrina Corlette, a professor at Georgetown University’s Health Policy Institute. “But now that they’ve got it, they clearly value it.”

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

Most of the individuals who purchase plans as a result of they don’t get protection via work or the federal government, 75 %, stated they purchased insurance coverage to guard towards excessive medical payments, and 66 % stated peace of thoughts was a significant motive.

In February, President Donald Trump eased some of the restrictions on short-term insurance coverage, permitting them to cowl individuals for 12 months as a substitute of three.

Critics fearful this different would draw individuals away from conventional insurance coverage and weaken the person market. According to the ballot, although, solely 12 % of respondents shopping for on that market stated they’d be thinking about shopping for one of many short-term plans.

Georgetown’s Corlette cautioned that these numbers may change when persons are confronted with an precise alternative subsequent open enrollment season.

“If you look at how these things are marketed, your average consumer will not be able to tell that these products are any different from a traditional health plan,” she stated.

Most individuals stated they didn’t face a premium improve this 12 months. Thirty-four % stated their premiums have been “about the same” as final 12 months and 23 % stated they really went down.

That’s not shocking, stated Joseph Antos, a resident scholar on the conservative American Enterprise Institute who follows the well being trade. Many customers noticed their premium subsidies rise too.

Thirty-five % of individuals stated one of many main causes they purchased insurance coverage was as a result of authorities subsidies made it inexpensive.

The subsidies that folks obtain, Antos famous, went as much as offset the premium improve in lots of instances, particularly if customers took the recommendation of consultants and shopped round for protection.

“They’re buying because they feel they need insurance and that their net premiums and deductibles add up to something they’re willing to buy,” Antos stated.

The ballot was performed Feb. 15-20 and March Eight-13 amongst 2,534 adults. The margin of sampling error is +/-2 share factors for the complete pattern, +/-7 share factors for all non-group enrollees and +/-9 share factors for market enrollees.

Kaiser Health News senior correspondent Julie Appleby contributed to this report.

Rachel Bluth: [email protected]”>[email protected], @RachelHBluth

Related Topics Cost and Quality Health Industry Insurance The Health Law KFF Polls src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>