Use Our Content This story could be republished without cost (details).

Small employers will extra simply be capable to band collectively to purchase medical insurance below rules issued Tuesday by the Trump administration, however the change may increase premiums for plans bought by way of the Affordable Care Act’s on-line marketplaces, analysts say.

The transfer loosens restrictions on so-called affiliation well being plans, permitting extra companies, together with sole proprietors, to hitch forces to purchase well being protection in bulk for his or her staff.

By successfully shifting small-business protection into the large-group market, it exempts such plans from ACA necessities for 10 “essential” well being advantages, comparable to psychological well being care and prescription drug protection, prompting warnings of “junk insurance” from shopper advocates.

Supporters say the brand new Labor Department guidelines, which the federal government estimated may create well being plans masking as many as 11 million individuals, will result in extra reasonably priced decisions for some employers.

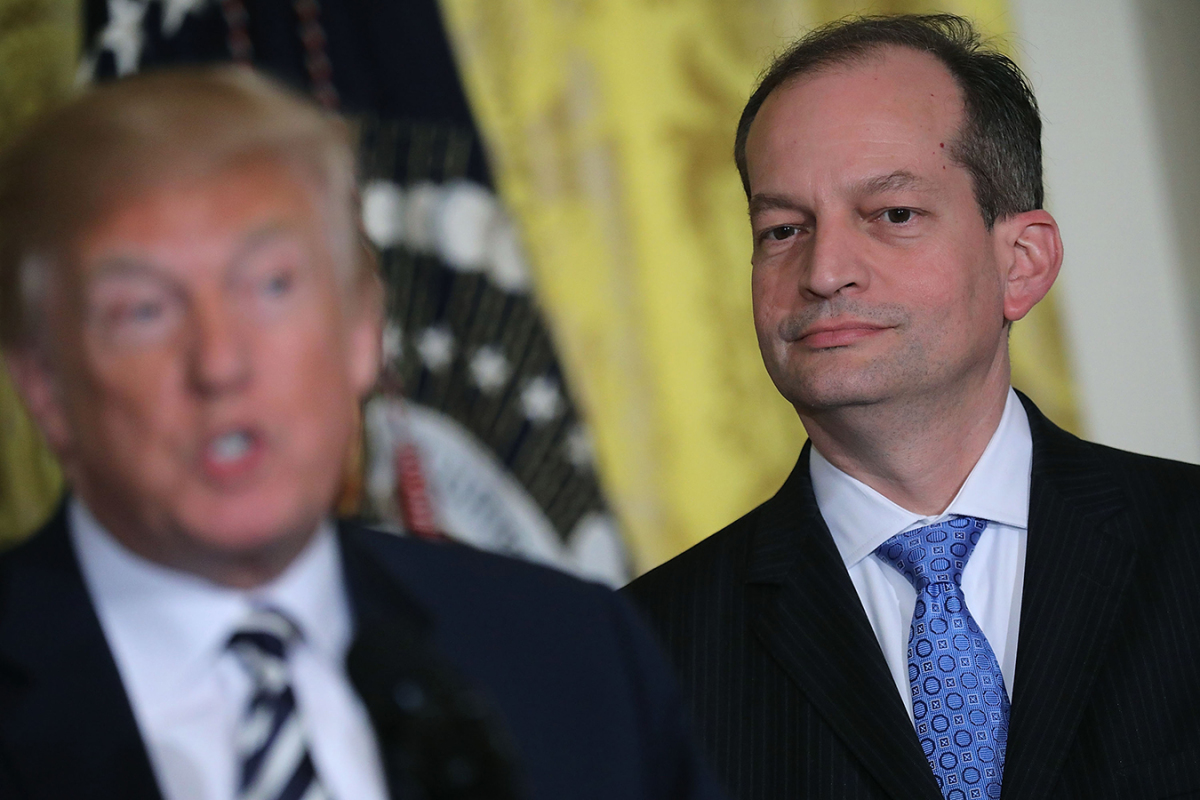

When it involves medical insurance, “the regulatory burden on small businesses should certainly not be more than that on large companies,” Labor Secretary Alexander Acosta instructed reporters Tuesday.

Existing guidelines restrict affiliation plans to teams of employers in the identical trade in the identical area.

Don’t Miss A Story

Subscribe to KHN’s free Weekly Edition e-newsletter.

The new rules eradicate the geographical restriction for related employers, permitting, for instance, family-owned auto-repair retailers in a number of states to supply one massive well being plan, stated Christopher Condeluci, a well being advantages lawyer and former Senate Finance Committee aide.

The guidelines, to be applied in levels into subsequent yr, additionally enable corporations in several industries in the identical area to kind a bunch to supply protection — even when the one purpose is to offer medical insurance.

Like different protection below the ACA, affiliation insurance coverage will nonetheless be required to cowl preexisting sicknesses.

Analysts warn that as a result of these modifications will possible siphon away employers with comparatively wholesome customers from ACA protection into less-expensive trade-association plans, the consequence may very well be increased prices within the on-line marketplaces.

“If you have a group that is healthier than average, you might get a better rate from one of these plans, and your broker is going to come and say, ‘Hey, I can get you a better deal,’” stated Dan Mendelson, president of Avalere Health, a consulting agency.

That would imply that, on stability, customers insured by way of ACA small-group and particular person plans may very well be older, sicker and costlier, including to years of abrasion of the ACA marketplaces engineered by Republicans hostile to the regulation.

Loosening guidelines for affiliation plans would result in three.2 million individuals leaving the ACA plans by 2022 and elevating premiums for these remaining in particular person markets by three.5 p.c, Avalere calculated this yr.

America’s Health Insurance Plans, the most important medical insurance coverage commerce group, issued a press release saying the regulation “may lead to higher premiums” in ACA insurance coverage and “could result in fewer insured Americans.”

Unlike ACA plans, affiliation protection doesn’t have to incorporate advantages throughout the broad “essential” classes, together with hospitalization and emergency care.

The National Association of Insurance Commissioners previously warned that such plans “threaten the stability of the small group market” and “provide inadequate benefits and insufficient protection to consumers.”

The American Academy of Actuaries has expressed similar concerns.

Business teams praised the change, proposed in draft form earlier this yr.

“We’ve been advocating for association health plans for almost 20 years, and we’re pleased to see the department moving aggressively forward,” stated David French, senior vice chairman of presidency relations for the National Retail Federation.

Association plans have been round for many years, though enrollment has been extra restricted for the reason that ACA’s passage. While a few of the plans have labored nicely for his or her members, others have a checkered historical past.

In April, for instance, Massachusetts regulators settled with Kansas-based Unified Life Insurance Company, which agreed to pay $2.eight million to resolve allegations that it engaged in misleading practices, comparable to claiming it lined providers that it didn’t.

The protection “was sold across state lines and was issued through a third-party association,” in accordance with a launch from the Massachusetts legal professional normal’s workplace.

Use Our Content This story could be republished without cost (details).

Jay Hancock: [email protected]”>[email protected], @JayHancock1

Julie Appleby: [email protected]”>[email protected], @Julie_Appleby

Related Topics Cost and Quality Insurance The Health Law Trump Administration src=”http://platform.twitter.com/widgets.js” charset=”utf-8″>