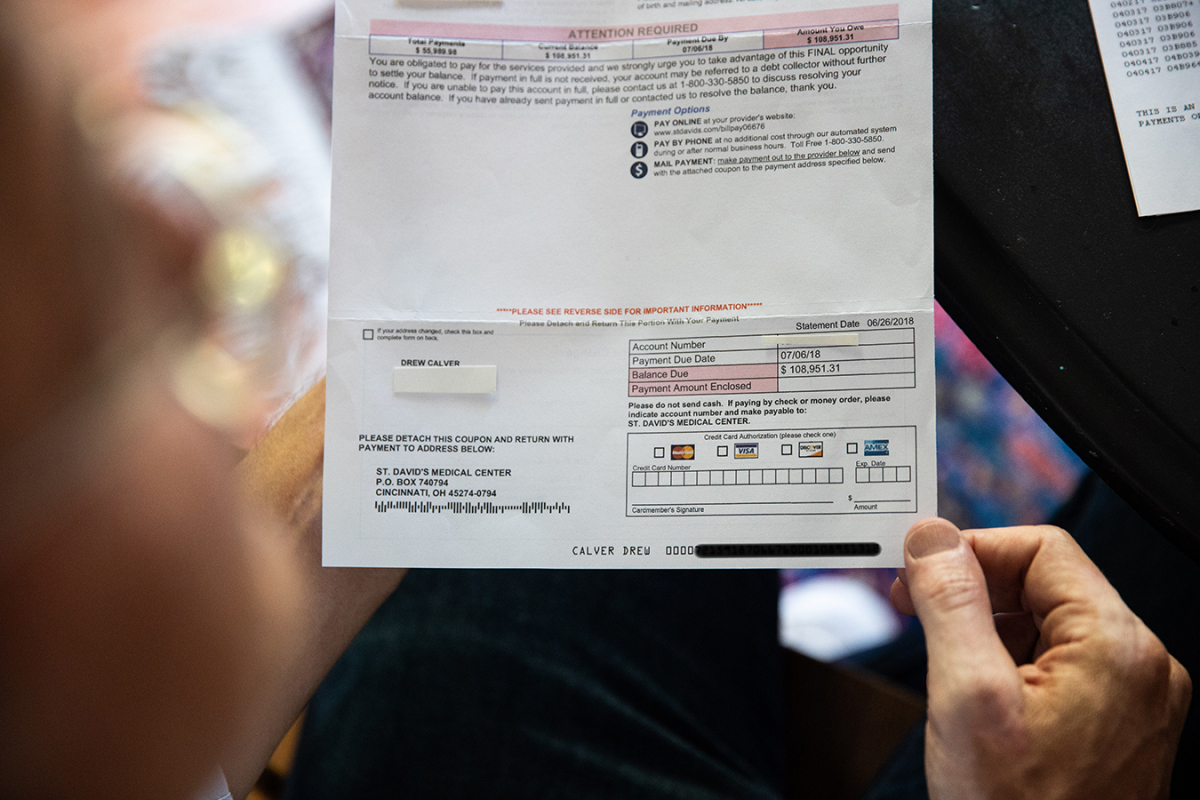

When Drew Calver had a coronary heart assault final 12 months, his well being plan paid almost $56,000 for the 44-year-old’s four-day emergency hospital keep at St. David’s Medical Center in Austin, Texas, a hospital that was not in his insurance coverage community. But the hospital charged Calver one other $109,000. That sum — a so-called steadiness invoice — was the distinction between what the hospital and his insurer thought his care was price.

Though in-network hospitals should settle for pre-contracted charges from well being plans, out-of-network hospitals can attempt to invoice as they like.

Calver’s invoice finally was diminished to $332 after Kaiser Health News and NPR published a story about it final month. Yet his expertise shines a lightweight on an unintended consequence of a wide-ranging federal legislation, which probably blindsides tens of millions of customers.

The federal legislation — referred to as ERISA, for the Employee Retirement Income Security Act of 1974 — regulates firm and union well being plans which can be “self-funded,” like Calver’s. That means they pay claims out of their very own funds, although they might be administered by a serious insurer similar to Cigna or Aetna. And whereas states more and more cross legal guidelines to guard sufferers from steadiness payments as extra hospitals and medical doctors go after sufferers to gather, ERISA legislation doesn’t prohibit steadiness billing.

Although Texas is one in every of almost two dozen states that present customers with a point of safety towards shock steadiness payments, these state legal guidelines don’t apply to self-funded plans.

It’s a reasonably frequent downside. About 60 percent of workers who get protection by way of their job have self-insured plans, and 18 p.c of individuals with protection by way of a big employer who have been admitted to the hospital in 2016 acquired not less than one invoice from an out-of-network supplier, in accordance with an analysis by the Kaiser Family Foundation. (Kaiser Health News is an editorially impartial program of the muse.)

Health researchers and advocates have recognized a lot of potential options that would deal with the issue on the federal or state stage. The courts are an alternative choice. Yet whether or not these efforts are politically possible when well being care is in play as a partisan soccer is one other matter.

Polarized views on acceptable reimbursement ranges for medical companies “limit stakeholders at both the federal and state level from making progress,” stated Kevin Lucia, a analysis professor at Georgetown’s Center on Health Insurance Reforms, who has analyzed state laws that prohibit steadiness billing.

A have a look at choices that consultants say would possibly handle the issue:

Change Federal Law

The easiest strategy to cease shock payments could be by way of restrictions imposed by federal laws that may apply to each state-regulated insurance policies offered by insurers and employer-sponsored self-funded well being plans, that are federally regulated.

There’s a precedent for this. The Affordable Care Act added provisions that apply to each sorts of plans. That legislation requires plans that cowl dependents to permit kids to remain on their mother and father’ plans till they flip 26, for instance, and canopy preventive advantages with out charging sufferers something out-of-pocket.

New laws may plug a giant loophole within the ACA. The well being legislation supplied some shopper protections for out-of-network emergency care, one of many greatest hassle spots for steadiness billing. Not solely do folks typically wind up at out-of-network hospitals once they have an emergency, however even when they go to an in-network hospital, the emergency physicians, specialists and different suppliers similar to pathologists and labs will not be of their well being plan’s community.

The ACA restricted a affected person’s value sharing for emergency companies to what they’d face in the event that they have been at an in-network facility. It additionally established requirements for the way a lot well being plans must pay the hospital or medical doctors for that care.

But the legislation didn’t prohibit out-of-network emergency medical doctors, hospitals and different suppliers, similar to ambulance companies, from steadiness billing customers for the quantities their well being plan didn’t pay.

Federal legislation may shut that loophole by prohibiting steadiness billing for emergency companies, in addition to hospital admissions associated to that emergency care.

Analysts on the University of Southern California-Brookings Schaeffer Initiative for Health Policy, who’ve prompt such a treatment, say the federal legislation may apply to any medical doctors and hospitals that take part within the Medicare program, as most do, to make sure that the impact could be widespread.

They additionally suggest prohibiting steadiness billing in non-emergency conditions when somebody visits an in-network facility however receives care from out-of-network medical doctors or is referred for outpatient lab or diagnostic imaging that’s exterior of the particular person’s well being plan community.

Still, the deep political scars left by the well being legislation battles would appear to preclude any bipartisan efforts in Washington to alter it.

“I’d love to see any kind of federal action,” stated Loren Adler, affiliate director on the USC heart, who co-authored the proposal. “It’s just hard to be super optimistic about anything happening in the near future.”

Revise Federal Regulations

The federal govt department may additionally weigh in on fixing the issue for self-insured protection. The Department of Labor could, for instance, concern a ruling that clarifies that states can regulate supplier fee, or require self-funded plans to take part in state dispute-resolution applications.

But consultants say counting on regulatory modifications to repair shock payments can also be a nonstarter on this political local weather.

“I don’t foresee the administration taking a hard look at the limits of its powers under the ACA,” stated Sara Rosenbaum, professor of well being legislation and coverage at George Washington University.

Look To The States

More than 20 states have legal guidelines defending customers to a point from shock payments from out-of-network emergency suppliers or in-network hospitals in the event that they’re lined by a state-regulated insurance coverage coverage, in accordance with an analysis by Georgetown researchers revealed by the Commonwealth Fund.

State legal guidelines fluctuate. Texas, for instance, requires that customers in HMO plans be held innocent from steadiness billing in out-of-network emergency and in-network conditions, however customers in PPO plans could be balance-billed.

New York’s legislation is extra complete, masking each sorts of plans and settings. New York protects customers from legal responsibility for out-of-network emergency and different shock payments, requires plans to reveal how they decide an affordable supplier fee and has a binding impartial dispute-resolution course of.

These legal guidelines sometimes don’t apply to self-funded plans, nonetheless. But that would change. A New Jersey law that went into impact final month permits self-funded plans to choose in to the state’s steadiness billing dispute-resolution course of. If a federally regulated plan decides to take part within the state program, medical doctors, hospitals and labs could be prohibited from balance-billing these customers, and any disputes will likely be dealt with by way of a binding arbitration course of.

For self-funded employers, particularly those that select to pay their staff’ shock payments, “this provides for a more formal structure and some relief,” stated Wardell Sanders, president of the New Jersey Association of Health Plans.

There are different potentialities for addressing shock payments on the state stage, coverage consultants say. While states can’t regulate self-funded well being plans, they do regulate medical doctors and hospitals and different suppliers.

States may merely cap the quantity that suppliers can cost for out-of-network care, for instance, or prohibit practitioners like radiologists and pathologists, who don’t deal straight with sufferers, from billing them for companies, stated Adler.

“As long as providers can charge whatever they please, the problem won’t go away,” stated Adler.

Will The Courts Weigh In?

These billing disputes hardly ever find yourself in court docket, primarily as a result of attorneys are hesitant to take them since there aren’t any assured legal professional’s charges.

A current Colorado case was a uncommon success for a affected person. A jury in June sided with Lisa French, a clerk at a trucking firm, who was shocked by a $229,000 steadiness invoice for spinal fusion surgical procedure. Saying the fees have been unreasonable, the jury knocked down her share of that invoice to only $766.74.

The hospital was paid almost $75,000 by her well being protection, an quantity her insurer felt in-built a good revenue margin, however the hospital claimed fell brief.

That raises the query on the coronary heart of many disputes over steadiness billing: What is a good worth?

Hospitals argue they need to get no matter quantity they set as fees on their grasp record of costs. Attorneys for sufferers, nonetheless, argue honest worth ought to be nearer to these discounted charges hospitals settle for of their contracts with insurers.

Hospitals typically refuse to reveal these discounted charges, leaving sufferers combating shock payments little details about what different folks pay.

Several current court docket circumstances — together with state Supreme Court rulings in Georgia and Texas — required hospitals to offer these discounted charges, though the rulings didn’t say these discounted costs are finally what sufferers would owe.