This story is a part of a partnership that features WBUR, NPR and Kaiser Health News.

This story might be republished without cost (details).

Kristina Cunningham was in steady situation on a night in June, when EMTs lifted her gurney right into a medical flight, certain for Boston.

The 34-year-old couldn’t use her proper arm or converse clearly after a stroke six days earlier, and nonetheless had two blood clots on the base of her mind. Cunningham’s dad, Jim Royer, remembers medical doctors on the small hospital in Wichita, Kan., the place Cunningham had attended a household wedding ceremony, saying she wanted to see a neurosurgeon.

“There was discussion of flying her to St. Louis, there was discussion of flying her to Chicago, there was discussion of flying her to Dallas,” Royer recalled, however “we don’t have family in any of those locations.”

So the medical doctors organized to switch Cunningham, by way of an Angel MedFlight Learjet, to Massachusetts General Hospital, the place she could be recognized with a rare blood vessel disease of the brain. MGH is about an hour from Cunningham’s dwelling in Berlin, Mass. — and her 7-year-old son. Cunningham’s medical doctors and her insurer, CareFirst BlueCross BlueShield, based mostly in Maryland, agreed the switch was medically vital.

“We assumed it would be [covered],” Royer mentioned, “because it was supposedly preapproved by the insurer before any flight took place.”

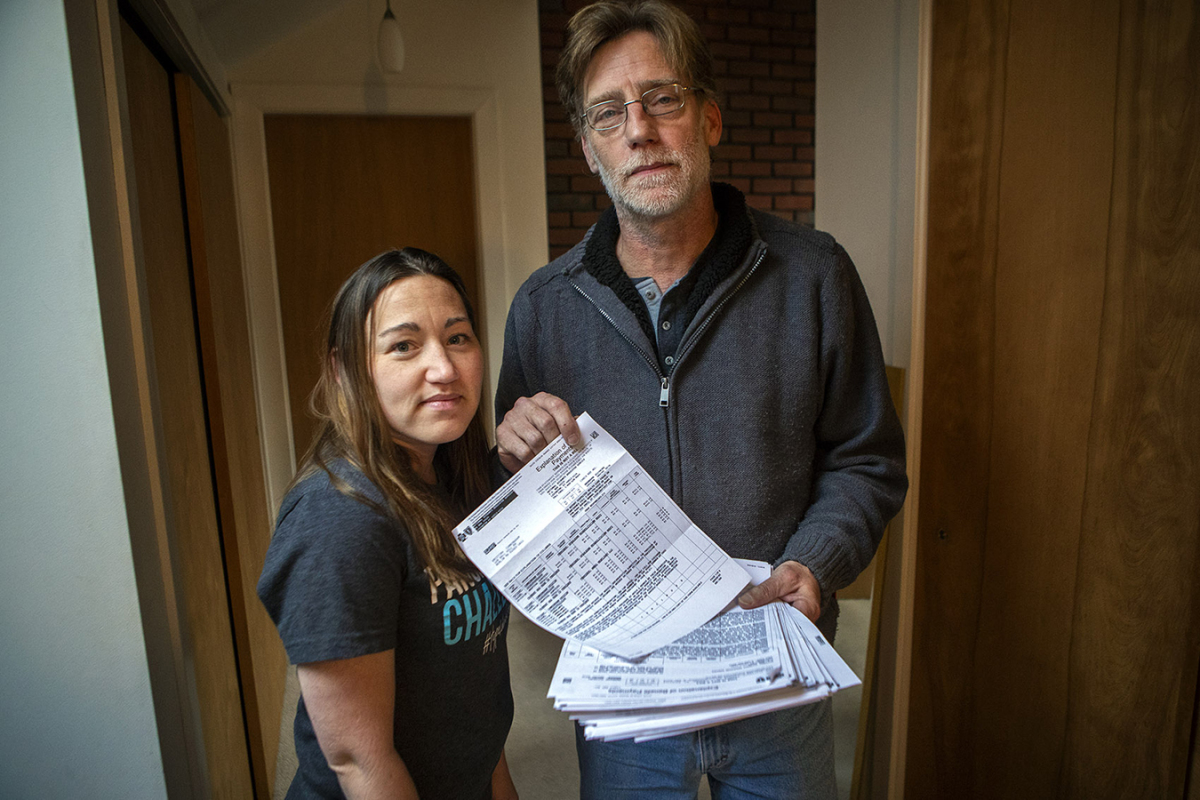

Royer mentioned he and Cunningham didn’t take into consideration the Angel MedFlight piece of her well being scare once more till a letter arrived in August. It was a one-page “explanation of benefits” with a jaw-dropping whole in a column labeled “other amounts not covered.”

“When I got the bill for $474,725, I’m thinking six or seven flights, and you can buy a whole new jet,” Royer mentioned with a wry giggle.

That practically half-million is the whole of 4 objects, the most important of which is a per-mile cost. That determine, $389,125, breaks all the way down to $275 a mile.

“It’s larger than any surprise medical bill I’ve personally seen,” mentioned Chuck Bell, program director for the advocacy division at Consumer Reports. “It’s really outrageous.”

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

In a study final yr, Consumer Reports detailed a number of the causes excessively excessive air ambulance payments have change into extra frequent. Use of air ambulances is rising as extra rural hospitals close, child boomers age and the usage of telemedicine will increase.

“The industry has really grown by leaps and bounds over the last 15 years and prices have doubled or tripled,” Bell mentioned. “Most of the operators of air ambulances now are for-profit, Wall Street-type corporations reporting very large profits to investors.”

The Association of Air Medical Services (AAMS), a commerce group, counters that it’s not distinctive, that many hospitals and well being insurers throughout the nation are additionally for-profit and that some are owned by personal fairness corporations.

AAMS mentioned a key purpose payments for sufferers with personal insurance policy are sometimes excessive is that this: Companies need to make up for the cash they lose transporting different sufferers.

“Medicare pays about 60 percent of the cost of the flight. Medicaid pays 35 percent or less. Self-paid patients pay a few cents on the dollar. And that has led to a crisis of being able to sustain the service,” Christopher Eastlee, AAMS vice chairman for presidency relations, mentioned in an announcement, stressing that he has value information just for emergency helicopter transports, not jets just like the one through which Cunningham traveled.

In 2018, Medicare paid $8.65 per mile for a fixed-wing plane just like the Learjet that transported Cunningham. That’s a stark distinction to Angel MedFlight’s $275 cost per mile. There aren’t any pointers for figuring out cheap expenses on this case.

Cunningham’s insurer, CareFirst, initially paid $14,304.55, leaving about $460,420 unpaid. In Massachusetts, a ground-based ambulance couldn’t demand that Cunningham pay the steadiness, as state legislation doesn’t permit so-called steadiness billing. But air ambulances are ruled by federal aviation legal guidelines. There are quite a few instances of corporations demanding funds from sufferers. Just a few states have tried to intervene however been unsuccessful, with courts saying that federal law prevails.

Cunningham has been centered on recovering her speech and making ready for surgical procedure. In January, she is going to meet together with her medical doctors to determine which kind of surgical procedure they suggest for eradicating or bypassing the blood clots on the base of her mind.

But Cunningham and her father have one other fear: what the mail might deliver.

“I don’t know, we’ll see,” Cunningham mentioned, with a shrug.

“It’s a big bill to be sitting out there wondering what’s going on,” mentioned Royer, who contacted KHN-NPR’s Bill of the Month on his daughter’s behalf. “It would force her into bankruptcy.”

Angel MedFlight COO Andrew Bess informed WBUR the corporate is negotiating with CareFirst and won’t demand cost from Cunningham.

“We’re quite confident we’ll come to a clear resolution despite the insurer placing the patient in the middle of the dispute,” mentioned Bess.

Royer mentioned it was a letter from Angel MedFlight that sounded threatening. As he learn it, the corporate informed Cunningham she should signal over the rights for Angel MedFlight to barter with CareFirst or threat being held liable if the insurer didn’t pay. Cunningham signed the request.

Bell, with Consumer Reports, mentioned agreeing to such phrases might be dangerous. Some air ambulance corporations ask for detailed information concerning the affected person’s private funds, data they then use to find out how a lot the affected person will pay if the insurance coverage reimbursement is deemed insufficient.

During inquiries for this story, CareFirst informed WBUR it will enhance the proposed cost to Angel MedFlight. The insurer mentioned it had found an error in its preliminary reimbursement to Angel MedFlight. CareFirst is now proposing to pay $70,864.90, or about one-seventh of the unique cost.

“Unfortunately, exorbitant charges like these by air ambulance providers are not uncommon,” mentioned Scott Graham, a spokesman for CareFirst, in an e-mail. “This is an issue because companies like Angel MedFlight typically do not contract with health insurers on negotiated rates.”

WBUR forwarded this replace to Bess, who referred to as it a “meaningful offer” in his emailed response.

“We provide a valuable service, and for that providers should be fairly compensated and reimbursed,” Bess mentioned. “We strive to work with our patients and advocate on behalf of them to get coverage rightfully owed to them under their insurance plans.”

Royer, a retired Air Force air visitors management methods supervisor, is aware of one thing about the price of working jets. To him, it appears to be like like Angel MedFlight inflated the invoice, hoping the insurer would conform to a beneficiant settlement.

“I guess that the way things work nowadays. You ask for the moon and if you only get a large island, that’s what you get,” Royer mentioned.

Bess responded to Royer’s declare in an announcement.

“Staffing what is essentially an Intensive Care Unit at 30,000 feet presents unique medical and aviation challenges that may not be apparent to those outside of the medical aviation industry,” Bess wrote. “The amount we receive per flight is a fraction of the billed charge.”

Patients caught up in an air ambulance billing dispute can file a complaint with the U.S. Department of Transportation.

A latest push for stricter federal billing laws was stripped out of the Federal Aviation Reauthorization Act, handed in October. The laws did set up a council of trade representatives, together with air ambulance suppliers and insurance coverage firm representatives, amongst others, to write and re-evaluate consumer protections, together with balance-billing practices. It didn’t add a requirement for extra value and different information transparency referred to as for in a Government Accountability Office report on the air ambulance trade.

The National Association of Insurance Commissioners says federal laws is required in order that states can intervene to oppose unreasonable air ambulance expenses. Lawmakers from rural states, together with Sen. Jon Tester, a Montana Democrat, mentioned they’ll reintroduce such legislation.

The air ambulance commerce group says any such change would create “borders in the sky” that may intrude with lifesaving air rescues throughout state borders.

This story is a part of a partnership that features WBUR, NPR and Kaiser Health News.

Do you may have an attention-grabbing or outrageous medical invoice you’d like KHN and NPR to look at? Tell us about it!

This story is a part of a partnership that features WBUR, NPR and Kaiser Health News.

This story might be republished without cost (details).

Martha Bebinger, WBUR: [email protected]”>[email protected], @mbebinger

Related Topics Cost and Quality Health Care Costs Health Industry Insurance Bill Of The Month Emergency Medicine Massachusetts src=”http://platform.twitter.com/widgets.js” charset=”utf-Eight”>