One of California’s largest medical insurance plans has distinguished itself, and never in a great way.

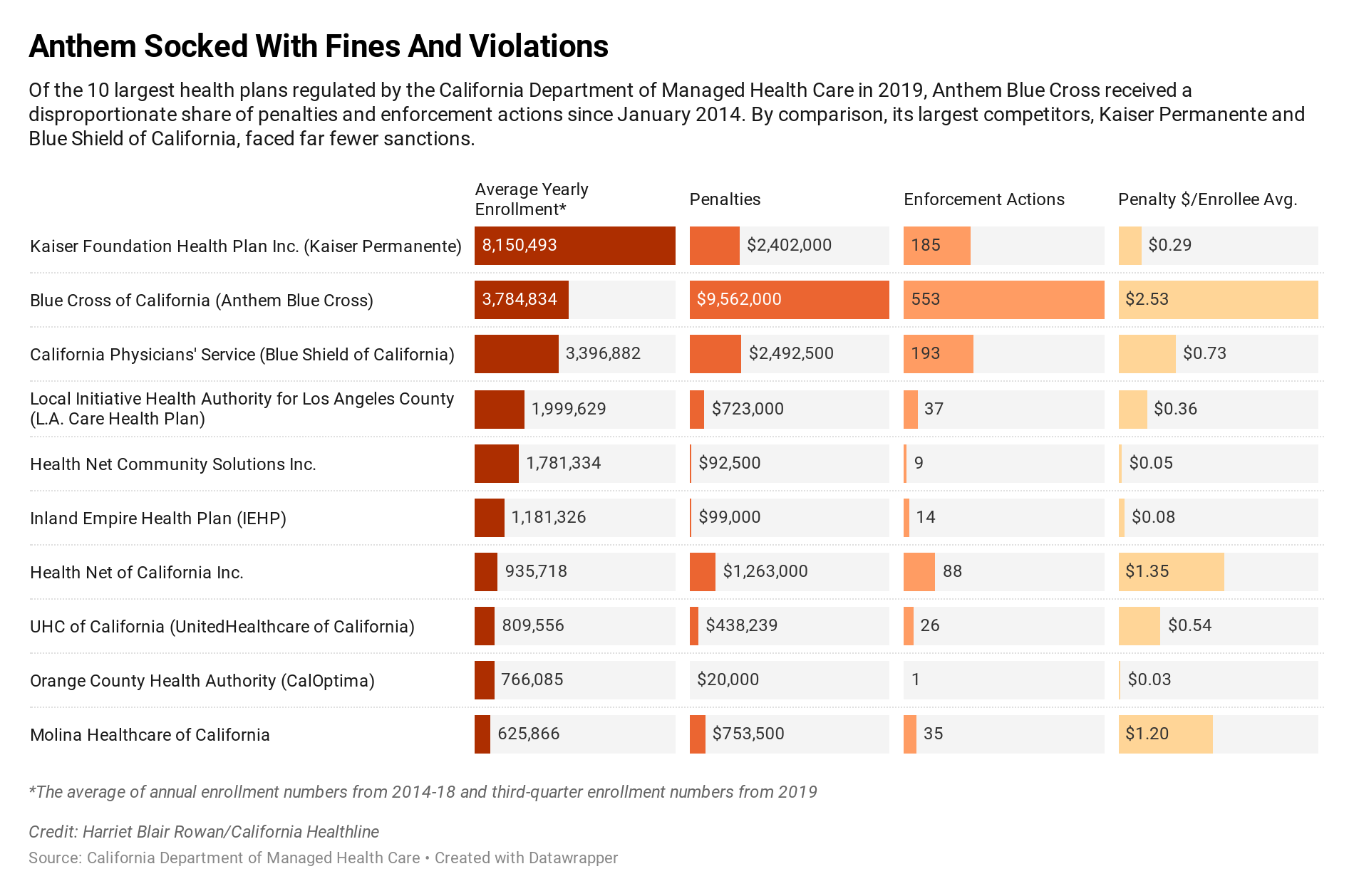

The state Department of Managed Health Care hit Anthem Blue Cross with $9.6 million in fines from January 2014 via early November 2019, in accordance with a California Healthline evaluation of company knowledge. That is about 44% of the $21.7 million in penalties the division issued towards full-service well being plans throughout that interval.

And but, Anthem lined solely 10% to 13% of Californians with department-regulated plans. An annual common of three.eight million Californians have been enrolled within the plan over the interval analyzed.

By comparability, Kaiser Permanente lined practically one-third of Californians in department-regulated plans in that timeframe, however obtained 11% of the penalties. (Kaiser Health News, which produces California Healthline, isn’t affiliated with Kaiser Permanente.)

“One reason Blue Cross has more actions is due to the plan’s historical failures to properly identify and handle enrollee grievances and appeals,” division spokeswoman Rachel Arrezola mentioned by way of e mail.

Anthem mentioned it takes all enrollee grievances significantly.

“Anthem has been making significant changes in its grievance and appeals process, as well as investments in system improvements to help ensure we are simplifying the healthcare experience for consumers,” mentioned spokesman Michael Bowman by way of e mail.

The fines towards Anthem are associated to lots of the 553 enforcement actions that the division has taken towards the well being plan for violations similar to taking too lengthy to reply to enrollee grievances, inappropriately denying claims and never protecting the price of out-of-network care that ought to have been lined.

The sanctions towards Anthem make up greater than one-third of the 1,432 enforcement actions the division issued. They can embody settlement agreements requiring plans to alter dangerous practices, cease-and-desist orders, judicial rulings and civil complaints.

“The primary purpose of an enforcement action is to change the health plan’s behavior to comply with the law,” Arrezola mentioned.

The dates of the enforcement actions don’t all the time coincide with when the violations occurred. The division can take years to course of some enforcement actions and in addition processes some in batches, making year-over-year comparisons deceptive.

In 2017, the division issued a $5 million fine to Anthem for repeatedly failing to resolve client grievances in a well timed method. But after prolonged negotiations, the division and the well being plan settled in June on a $2.eight million advantageous together with an settlement that Anthem would make investments $eight.four million to make enhancements.

The Department of Managed Health Care, which oversees well being plans that cowl about 26 million Californians, is the state’s largest medical insurance regulator. Since 2000, when the company was created, it has levied $73 million in fines to licensed well being plans.

Anthony Wright, government director of the advocacy group Health Access California, mentioned fines are an vital approach to shield customers, however he has advocated for even bigger penalties.

“We don’t want these transgressions to be the cost of doing business when [insurers] have not met the standards and consumer protections that we expect of them,” he mentioned.

Wright mentioned it’s vital for customers to examine well being plan enforcement data earlier than they enroll, which will be accessed via the department’s website.

But Wright acknowledged that many individuals don’t have a selection, making the division’s oversight function much more vital.

“The most important thing is the fines and the corrective actions,” Wright mentioned, “to make sure these practices end.”