BAYONNE, N.J. — For 5 years, Rasha Salama has taken her two youngsters to Dr. Inas Wassef, a pediatrician a number of blocks from her residence on this blue-collar city throughout the bay from New York City.

Salama likes the physician as a result of Wassef speaks her native language — Arabic — and has workplace hours at handy occasions for youngsters.

“She knows my kids, answers the phone, is open on Saturdays and is everything for me,” she mentioned.

But UnitedHealthcare is dropping Wassef — and lots of of different medical doctors in its central and northern New Jersey Medicaid doctor community. The transfer is forcing hundreds of low-income sufferers equivalent to Salama to forsake longtime physicians.

Across the nation, enterprise and contractual disputes are separating sufferers from longtime medical doctors. This typically happens when medical doctors don’t wish to settle for the charges insurers are keen to pay. It generally happens when insurers’ enterprise plans require having a narrower community of medical doctors — medical doctors whose observe patterns could also be simpler to manage.

But on this case, the reason for the exclusion goes to even deeper enterprise connections: Wassef and different medical doctors say the insurer seems to be attempting to shift sufferers to Riverside Medical Group, a 20-office physicians’ observe owned by Optum, a sister firm of UnitedHealthcare, each of that are subsidiaries of UnitedHealth Group. UnitedHealthcare is actually forcing sufferers to switch to medical doctors it controls, the medical doctors allege.

Indeed, a number of sufferers mentioned the well being plan directed them to Riverside when informing them their medical doctors had been being dropped.

Lawrence Downs, CEO of the Medical Society of New Jersey, mentioned he estimates UnitedHealthcare is attempting to take away lots of of medical doctors in central and northern New Jersey from its community. That is identical space the place Riverside Medical operates, he famous.

“It seems like they are steering patients away from small, community-based doctors to large groups that they own,” he mentioned.

Good For Profits

That raises questions on whether or not this kind of “vertical consolidation” — the time period for a observe occurring throughout the nation — is a method that’s good for income however unhealthy for sufferers.

UnitedHealthcare mentioned the adjustments aren’t a part of a marketing campaign to get as many sufferers as potential to the Riverside observe. It factors out that it’s retaining the community-based medical doctors, like Wassef, in its networks to deal with its Medicare Advantage and industrial plan members.

But, specialists say, traumatic disruptions in doctor-patient relationships are an inevitable results of ongoing shifts within the sophisticated enterprise of U.S. well being care.

Salerno’s essential workplace is in a three-story, 19th-century home in East Orange that his father used for his medical observe within the 1960s. About 40% of his sufferers are on Medicaid.

Facing a speedy consolidation of medical doctors’ practices and hospital techniques — which have hefty negotiating energy to demand excessive charges — insurers have restricted choices to manage prices and keep a constructive steadiness sheet, mentioned Jacob Wallace, an assistant professor of public well being at Yale University. Medicaid plans are particularly affected as a result of, not like industrial plans and even Medicare, they’ll’t enhance premiums or demand copayments.

“Plans face a challenging landscape to keep costs down,” Wallace mentioned. As a end result, well being plans have taken different approaches, together with narrowing supplier networks and shopping for their very own doctor practices, he mentioned.

But additional complicating issues, many Medicaid and Medicare managed-care applications are contracted out to personal, for-profit insurers equivalent to UnitedHealthcare. They need to create returns for shareholders. With surging enrollment in authorities applications, UnitedHealthcare has loved rising profits and a stock price that has soared tenfold since 2010.

Wassef and about two dozen different physicians filed a federal lawsuit in September to get reinstated. Wassef, whose termination is scheduled in May, mentioned the transfer may significantly have an effect on her observe as a result of 80% of her sufferers are insured by UnitedHealthcare.

UnitedHealthcare gained tens of millions of latest prospects after the Affordable Care Act led New Jersey and 35 different states and the District of Columbia to increase Medicaid and states turned to personal insurers to deal with the enterprise. Salama and another UnitedHealthcare prospects mentioned they like their insurance coverage plan as a result of it affords richer advantages than different Medicaid choices and covers the drugs they use.

The firm operates New Jersey’s second-largest Medicaid well being plan, with 418,000 members. (The state Department of Human Services has blocked UnitedHealthcare from enrolling any further Medicaid members, a extreme and uncommon penalty. That transfer — which isn’t associated to the termination of medical doctors’ contracts — stems from complaints associated to care administration and discharge planning, the well being plan’s name heart and different points.)

An organization spokesperson acknowledged the well being plan is dropping 2% of its Medicaid medical doctors, saying the transfer was designed to assist management prices.

“As health care costs continue to rise, we are working to mitigate the impact on the customers, states and members we serve by negotiating with care providers on their behalf to keep reimbursement rates affordable,” the corporate mentioned in an announcement. “We understand that our members have personal relationships with their doctors and that network changes can be difficult.”

A Practice Destroyed

New Jersey Medicaid officers refused to touch upon whether or not they’re involved about UnitedHealthcare’s actions. But sufferers caught up within the standoff have motive to fret, mentioned Linda Schwimmer, CEO of the New Jersey Health Care Quality Institute, a coalition of well being plans, suppliers and a wide range of well being commerce teams.

“Once you have a trusted relationship with a provider, it means a lot and it goes to the quality [of your care] because if you are seeing the same providers and you trust them, you are more likely to take your medication and adhere to whatever care plan you have,” she mentioned.

Velylia McIver switched to a brand new Medicaid well being plan after Salerno was initially dropped by UnitedHealthcare with a view to preserve seeing him.

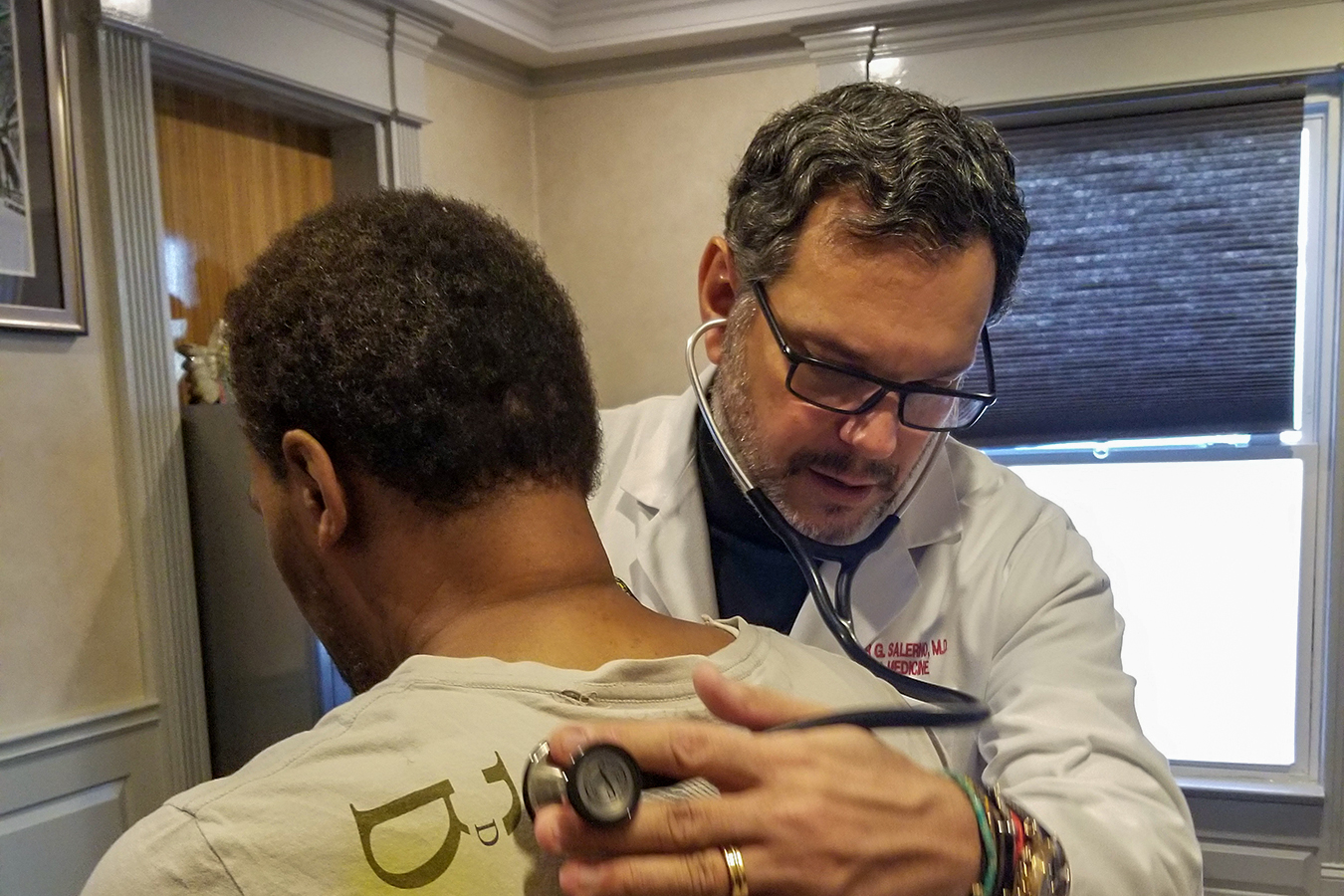

Dr. Alexander Salerno, an internist who runs a 17-doctor multispecialty observe in East Orange, New Jersey, one other plaintiff within the lawsuit, is helping lead the court fight. Salerno’s essential workplace is in a three-story, 19th-century home that his father used for his medical observe within the 1960s. About 40% of his sufferers are on Medicaid.

Until the dispute started final yr, Salerno suggested his sufferers to join UnitedHealthcare due to its broad array of advantages, together with imaginative and prescient and dental care, and due to the convenience in referring to specialists.

And UnitedHealthcare by no means complained about this group’s ability. In reality, the group acquired a $130,000 bonus final yr for its excellent care to sufferers. Salerno mentioned Riverside Medical supplied to purchase his group observe in 2018, however he declined.

Since UnitedHealthcare introduced it might drop his group from the community, greater than 500 of his practices’ sufferers have already modified medical doctors to stick with the UnitedHealthcare plan, Salerno mentioned.

“It’s not a bad insurance company. It just seems like they have become greedy trying to control both ends of the pendulum — wanting to be the payer and provider,” Salerno mentioned.

A federal choose ordered the case to be heard by a impartial arbitrator, which in late November granted an emergency injunction that may preserve Salerno from being faraway from UnitedHealthcare’s community till an arbitrator decides on a everlasting injunction, which is anticipated in March.

But that leaves sufferers in limbo.

Glorida Rivera, 68, mentioned UnitedHealthcare’s resolution to drop Salerno was upsetting as a result of she relied on him to take care of her diabetes, thyroid and coronary heart circumstances. She credit Salerno for referring her to a heart specialist, who put stents in her coronary heart to clear a blockage.

“He knows my whole story, so why do I have to change?” puzzled Rivera. Nonetheless, she is sticking with UnitedHealthcare.

Velylia McIver, 83, determined in November to seek for one other plan so she may stick with Salerno. But it took her greater than a month to get protection for some drugs.

“I feel caught in the middle of all this, and it’s the pits,” McIver mentioned.